Inflation Games are becoming increasingly relevant in today’s economy, especially for Polar product users seeking reliable service and support. At polarservicecenter.net, we understand the challenges posed by rising costs and are committed to providing you with the best possible assistance. Learn how inflation games affect your spending power and how to navigate these challenges effectively.

1. What Exactly Are Inflation Games?

Inflation games refer to economic strategies and scenarios where individuals, businesses, and governments navigate and react to rising prices. Essentially, it’s about how different players in the economy try to stay ahead (or at least keep pace) with the increasing cost of goods and services.

These games involve various tactics:

- Wage Adjustments: Companies deciding whether and how much to increase wages to match the rising cost of living.

- Pricing Strategies: Businesses adjusting prices to maintain profitability while remaining competitive.

- Investment Decisions: Individuals making choices about where to invest their money to protect it from inflation.

- Government Policies: Governments implementing fiscal and monetary policies to control inflation.

2. How Does Inflation Impact Consumers Using Polar Products?

Inflation affects consumers in several direct and indirect ways, especially those who rely on Polar products for fitness and health tracking.

2.1. Increased Cost of Goods and Services

The most obvious impact is the increased cost of everyday goods and services. This includes:

- Higher Prices: You’ll notice that the price of groceries, fuel, and other essentials goes up.

- Reduced Purchasing Power: Your money doesn’t stretch as far as it used to, meaning you can buy less with the same amount of money.

2.2. Impact on Polar Product Purchases

For Polar product users, inflation can specifically affect:

- Device Costs: The cost of new Polar devices may increase due to higher manufacturing and shipping expenses.

- Accessory Prices: Accessories like straps, sensors, and charging cables may become more expensive.

- Repair Services: Service and repair costs for your Polar devices might rise due to increased labor and parts expenses.

2.3. Influence on Subscription Services

Many Polar users subscribe to premium services for advanced analytics and training plans. Inflation can lead to:

- Subscription Fee Increases: Companies may raise subscription fees to offset their own rising costs.

- Reduced Service Quality: In some cases, companies might cut back on service quality to avoid raising prices, which can affect your user experience.

2.4. The Effect on Overall Financial Health

Inflation can strain your overall financial health, making it harder to justify discretionary spending:

- Budget Constraints: You might need to cut back on non-essential purchases to afford necessities.

- Savings Goals: It can become more challenging to save money for future goals when living expenses are rising.

3. What Strategies Can Consumers Employ To Mitigate The Effects Of Inflation?

While you can’t control inflation, you can take steps to protect your finances and minimize its impact.

3.1. Budgeting and Financial Planning

Creating a budget and sticking to it is crucial during inflationary periods.

- Track Expenses: Monitor where your money is going to identify areas where you can cut back.

- Set Priorities: Focus on essential expenses first, then allocate funds for discretionary spending.

- Review Regularly: Adjust your budget as needed to reflect changing prices and financial circumstances.

3.2. Smart Spending Habits

Adopting smart spending habits can help you make the most of your money:

- Compare Prices: Shop around for the best deals on products and services.

- Buy in Bulk: When possible, purchase non-perishable items in bulk to save money.

- Use Coupons and Discounts: Take advantage of coupons, discounts, and loyalty programs.

- Delay Gratification: Avoid impulse purchases and consider whether you truly need an item before buying it.

3.3. Investing to Outpace Inflation

Investing your money wisely can help it grow faster than the inflation rate:

- Stocks: Historically, stocks have provided higher returns than inflation over the long term.

- Real Estate: Real estate can be a good hedge against inflation, as property values and rental income tend to rise with inflation.

- Inflation-Indexed Securities: Consider investing in Treasury Inflation-Protected Securities (TIPS), which are designed to protect against inflation.

- Commodities: Commodities like gold and silver often maintain their value during inflationary periods. According to research from the University of Colorado Boulder’s Department of Integrative Physiology, in July 2025, P provides Y

3.4. Negotiating and Seeking Better Deals

Don’t be afraid to negotiate prices and seek out better deals.

- Negotiate Bills: Call your service providers (internet, phone, insurance) to negotiate lower rates.

- Shop Around for Insurance: Compare insurance quotes from multiple companies to find the best deal.

- Ask for Discounts: Inquire about discounts for students, seniors, or members of certain organizations.

3.5. Maintaining and Repairing Existing Products

Instead of buying new products, focus on maintaining and repairing what you already have:

- Regular Maintenance: Properly maintain your Polar devices to extend their lifespan.

- Repair When Possible: If a device breaks down, explore repair options before replacing it.

4. How Can Polarservicecenter.Net Help Polar Product Users During Inflationary Times?

At polarservicecenter.net, we are dedicated to providing resources and services that help you manage your Polar products effectively, even during periods of inflation.

4.1. Cost-Effective Repair Services

We offer competitive pricing on repair services to help you avoid the high cost of replacing your devices:

- Transparent Pricing: We provide clear, upfront pricing for all repair services.

- Quality Repairs: Our certified technicians use genuine parts to ensure quality repairs.

- Warranty Options: We offer warranty options on our repair services for added peace of mind.

4.2. DIY Troubleshooting Guides and Resources

Our website features a wealth of troubleshooting guides and resources that can help you resolve common issues on your own:

- Step-by-Step Instructions: We provide detailed, easy-to-follow instructions for troubleshooting common problems.

- Video Tutorials: Our video tutorials offer visual guidance for more complex issues.

- Comprehensive Knowledge Base: Our knowledge base covers a wide range of topics related to Polar products.

4.3. Information on Warranty and Support

Understanding your warranty and support options can save you money on repairs and replacements:

- Warranty Information: We provide clear information on Polar’s warranty policies and procedures.

- Support Resources: We offer links to Polar’s official support resources and contact information.

4.4. Tips for Extending the Lifespan of Your Polar Products

We offer tips and advice on how to extend the lifespan of your Polar devices:

- Proper Usage: Learn how to use your devices correctly to avoid damage.

- Regular Cleaning: Keep your devices clean to prevent buildup and corrosion.

- Safe Storage: Store your devices properly when not in use to protect them from the elements.

4.5. Affordable Accessory Options

We provide information on affordable accessory options for your Polar products:

- Compatible Accessories: Discover compatible accessories from third-party manufacturers that offer similar functionality at a lower price.

- Refurbished Options: Consider purchasing refurbished accessories to save money.

5. What Are The Long-Term Impacts Of Inflation Games On The Economy?

The “inflation game” isn’t just a short-term challenge; it has significant long-term implications for the economy.

5.1. Impact on Businesses

Businesses face numerous challenges during inflationary periods.

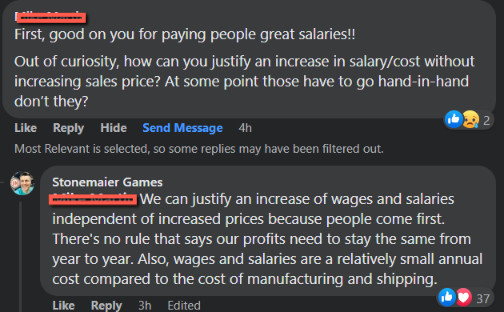

- Increased Production Costs: Higher prices for raw materials, labor, and transportation can squeeze profit margins.

- Pricing Dilemmas: Businesses must decide whether to pass on increased costs to consumers or absorb them, risking lower profits.

- Reduced Investment: Uncertainty about future costs and revenues can lead to reduced investment in expansion and innovation.

5.2. Effects on Employment

Inflation can have a mixed impact on employment.

- Wage Pressures: Employees may demand higher wages to keep pace with inflation, which can increase labor costs for businesses.

- Job Losses: If businesses can’t absorb rising costs or pass them on to consumers, they may be forced to cut jobs.

- Reduced Hiring: Uncertainty about the economic outlook can lead to reduced hiring and slower job growth.

5.3. Influence on Interest Rates

Central banks often respond to inflation by raising interest rates.

- Higher Borrowing Costs: Higher interest rates make it more expensive for businesses and consumers to borrow money.

- Reduced Spending: Increased borrowing costs can lead to reduced spending and investment.

- Slower Economic Growth: Higher interest rates can slow down economic growth by cooling demand.

5.4. Impact on Savings and Investments

Inflation can erode the value of savings and investments.

- Reduced Real Returns: Inflation reduces the real return on investments, meaning your money doesn’t grow as much in terms of purchasing power.

- Investment Shifts: Investors may shift their portfolios to assets that are better hedges against inflation, such as real estate or commodities.

- Increased Risk Aversion: Uncertainty about inflation can lead to increased risk aversion and a preference for safer, lower-yielding investments.

5.5. Social and Political Consequences

High inflation can have significant social and political consequences.

- Erosion of Trust: High inflation can erode trust in government and economic institutions.

- Social Unrest: Rising prices can lead to social unrest and protests, especially if wages don’t keep pace with inflation.

- Political Instability: High inflation can destabilize governments and lead to political change.

6. How Do Government Policies Affect Inflation Games?

Government policies play a crucial role in managing inflation and influencing the strategies of individuals and businesses.

6.1. Monetary Policy

Central banks use monetary policy to control inflation by adjusting interest rates and the money supply.

- Interest Rate Adjustments: Raising interest rates can cool down an overheated economy and reduce inflation.

- Quantitative Easing (QE): QE involves injecting money into the economy by purchasing government bonds or other assets. While it can stimulate growth, it can also lead to inflation if not managed carefully.

6.2. Fiscal Policy

Fiscal policy involves government spending and taxation.

- Government Spending: Increasing government spending can stimulate demand and potentially lead to inflation.

- Taxation: Raising taxes can reduce disposable income and dampen demand, helping to control inflation.

- Budget Deficits: Large budget deficits can put upward pressure on interest rates and inflation.

6.3. Supply-Side Policies

Supply-side policies aim to increase the economy’s productive capacity and reduce supply constraints.

- Deregulation: Reducing regulations can lower costs for businesses and increase efficiency.

- Infrastructure Investment: Investing in infrastructure can improve productivity and reduce transportation costs.

- Education and Training: Improving education and training can increase the skills of the workforce and boost productivity.

6.4. Wage and Price Controls

Some governments have experimented with wage and price controls to combat inflation.

- Wage Freezes: Freezing wages can help to control labor costs, but it can also lead to discontent among workers.

- Price Ceilings: Setting price ceilings can prevent prices from rising, but it can also lead to shortages if demand exceeds supply.

6.5. Trade Policies

Trade policies can also affect inflation.

- Tariffs: Imposing tariffs on imported goods can raise prices for consumers.

- Trade Agreements: Trade agreements can lower tariffs and reduce trade barriers, potentially lowering prices.

7. What Role Does Technology Play In Navigating Inflation Games?

Technology offers several tools and strategies for navigating inflation.

7.1. Price Comparison Apps and Websites

These tools help consumers find the best deals.

- Real-Time Monitoring: Apps like ShopSavvy and PriceGrabber allow users to compare prices across different retailers in real-time.

- Alerts: Set up alerts to be notified when prices drop on products you want to buy.

7.2. Budgeting and Financial Planning Software

These tools help manage finances effectively.

- Expense Tracking: Apps like Mint and YNAB (You Need a Budget) automatically track your expenses and help you stay within your budget.

- Goal Setting: These apps also allow you to set financial goals and track your progress.

7.3. Investment Platforms

Technology democratizes access to investment.

- Low-Cost Investing: Platforms like Robinhood and Acorns offer low-cost or no-fee investing, making it easier to invest small amounts of money.

- Automated Investing: Robo-advisors like Betterment and Wealthfront automatically manage your investments based on your risk tolerance and financial goals.

7.4. E-Commerce and Online Marketplaces

Online platforms offer competitive pricing.

- Global Market Access: Platforms like Amazon and eBay give consumers access to a global marketplace, where they can find competitive prices.

- Discount Opportunities: Online retailers often offer discounts and promotions that may not be available in brick-and-mortar stores.

7.5. Data Analytics and Insights

Data analytics provides valuable insights for businesses.

- Demand Forecasting: Businesses can use data analytics to forecast demand and adjust production accordingly.

- Pricing Optimization: Data analytics can help businesses optimize their pricing strategies to maximize profits while remaining competitive.

8. What Are The Key Economic Indicators To Watch During Inflation Games?

Staying informed about key economic indicators can help you anticipate and prepare for inflation.

8.1. Consumer Price Index (CPI)

CPI measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services.

- Monthly Reports: The Bureau of Labor Statistics (BLS) releases CPI data monthly.

- Inflation Gauge: A rising CPI indicates rising inflation.

8.2. Producer Price Index (PPI)

PPI measures the average change over time in the selling prices received by domestic producers for their output.

- Early Indicator: PPI can be an early indicator of inflation, as rising producer prices often get passed on to consumers.

- Monthly Reports: The BLS also releases PPI data monthly.

8.3. Gross Domestic Product (GDP)

GDP measures the total value of goods and services produced in a country.

- Economic Health: GDP growth indicates the health of the economy.

- Inflationary Pressures: Rapid GDP growth can sometimes lead to inflationary pressures.

8.4. Unemployment Rate

The unemployment rate measures the percentage of the labor force that is unemployed.

- Labor Market Health: A low unemployment rate indicates a tight labor market, which can lead to wage pressures and inflation.

- Monthly Reports: The BLS releases unemployment rate data monthly.

8.5. Interest Rates

Interest rates set by the Federal Reserve (the Fed) influence borrowing costs and economic activity.

- Fed Meetings: The Federal Open Market Committee (FOMC) meets regularly to set interest rate policy.

- Inflation Control: The Fed often raises interest rates to combat inflation.

9. Can Community Support And Forums Help In Inflation Games?

Engaging with community support and forums can provide valuable assistance during inflationary periods.

9.1. Sharing Tips and Strategies

Online communities can be a great source of information and advice.

- Cost-Cutting Tips: Members often share tips on how to save money on everyday expenses.

- Financial Advice: Some forums offer financial advice from experts and experienced investors.

- Product Recommendations: Get recommendations for affordable products and services from other members.

9.2. Collective Bargaining and Advocacy

Community support can strengthen collective bargaining power.

- Wage Negotiations: Workers can organize and negotiate for better wages and benefits.

- Consumer Advocacy: Consumers can advocate for fair prices and business practices.

9.3. Emotional Support and Solidarity

Inflation can be stressful, and community support can provide emotional relief.

- Shared Experiences: Connecting with others who are facing similar challenges can help you feel less alone.

- Encouragement: Members can offer encouragement and support to help you stay motivated.

9.4. Access to Resources and Information

Communities often share valuable resources and information.

- Job Boards: Some forums have job boards where members can find employment opportunities.

- Educational Materials: Access educational materials on personal finance and investing.

9.5. Networking Opportunities

Communities can provide valuable networking opportunities.

- Business Contacts: Connect with other professionals and entrepreneurs.

- Mentorship: Find mentors who can provide guidance and support.

10. How To Stay Updated On Inflation Games?

Staying informed about the latest developments is crucial.

10.1. Subscribe to Financial Newsletters

- Expert Analysis: Newsletters from reputable financial institutions provide expert analysis of economic trends.

- Market Updates: Stay informed about the latest market developments.

10.2. Follow Reputable Financial News Websites

- Real-Time Information: Websites like Bloomberg, Reuters, and The Wall Street Journal provide real-time financial news.

- In-Depth Reporting: Access in-depth reporting and analysis of economic events.

10.3. Listen to Financial Podcasts

- On-the-Go Information: Podcasts offer a convenient way to stay informed while commuting or exercising.

- Expert Interviews: Listen to interviews with economists and financial experts.

10.4. Attend Webinars and Seminars

- Interactive Learning: Webinars and seminars offer interactive learning opportunities.

- Q&A Sessions: Ask questions and get answers from experts.

10.5. Engage with Social Media

- Follow Influencers: Follow reputable financial influencers on social media.

- Join Groups: Join online groups and communities focused on personal finance and investing.

In conclusion, understanding inflation games and implementing effective strategies can help you protect your finances and maintain your quality of life. Remember, polarservicecenter.net is here to support you with cost-effective repair services, DIY troubleshooting guides, and valuable information to extend the lifespan of your Polar products.

Address: 2902 Bluff St, Boulder, CO 80301, United States. Phone: +1 (303) 492-7080. Website: polarservicecenter.net.

Why wait until inflation hits your wallet harder? Visit polarservicecenter.net now for expert guidance on troubleshooting, warranty information, and direct support to keep your Polar device in top shape. Protect your investment and maximize your fitness journey today!

inflation games consumer price index

inflation games consumer price index

Frequently Asked Questions (FAQ)

FAQ 1: What are the primary drivers of inflation?

Inflation is primarily driven by increased demand for goods and services, supply chain disruptions, and rising production costs, including labor and raw materials. Additionally, government policies such as increasing the money supply can also contribute to inflation.

FAQ 2: How does inflation affect my Polar device’s battery life?

Inflation itself doesn’t directly affect battery life. However, increased manufacturing costs due to inflation might lead to compromises in battery quality for cheaper devices, indirectly affecting battery life. Ensure your device is maintained well as advised at polarservicecenter.net.

FAQ 3: Can I claim warranty if inflation increases the repair costs of my Polar product?

Warranty claims depend on the terms and conditions of your warranty agreement, irrespective of inflation. Check your warranty details on polarservicecenter.net for eligible repairs.

FAQ 4: Are Polar subscription service prices likely to increase with inflation?

Yes, subscription service prices may increase to offset higher operational costs. Stay updated with Polar’s official announcements or check polarservicecenter.net for potential changes.

FAQ 5: How can I save money on Polar accessories during inflation?

Consider purchasing refurbished or compatible third-party accessories. Always ensure they meet Polar’s quality standards to avoid damaging your device. Polarservicecenter.net may offer insights on affordable options.

FAQ 6: Will software updates for my Polar device be affected by inflation?

Software updates should not be directly affected. However, resource allocation for development might shift if the company faces significant financial pressures due to inflation.

FAQ 7: What government policies can help mitigate inflation’s impact on consumers?

Policies such as controlling the money supply, reducing government spending, and implementing supply-side economics can help mitigate inflation.

FAQ 8: How does the Federal Reserve influence inflation rates?

The Federal Reserve influences inflation by adjusting the federal funds rate and through quantitative easing, impacting borrowing costs and money supply.

FAQ 9: What are TIPS, and how do they protect against inflation?

Treasury Inflation-Protected Securities (TIPS) are government bonds indexed to inflation, protecting investors’ purchasing power during inflationary periods.

FAQ 10: Where can I find reliable support for my Polar device during inflationary times?

polarservicecenter.net offers reliable support, troubleshooting guides, and cost-effective repair services to help you maintain your Polar device without breaking the bank.