Dealing with an IRS letter or notice can be daunting. Understanding what it means and knowing where to turn for help is crucial to resolving tax issues efficiently. As a TurboTax user, you have access to customer service resources designed to guide you through the audit process and provide support when you need it most. This article outlines how TurboTax customer service can assist you in understanding IRS notices and navigating audit support options.

It’s important to address any IRS letter or notice promptly to prevent further complications. The IRS issues various types of notices, each with a specific purpose. To understand the nature of your notice, refer to the number located on your IRS letter and consult resources like this article for detailed information on specific notice types such as CP11, CP12, CP14, and CP2000. These resources from TurboTax provide clarity on the necessary steps to take based on the specific notice you’ve received.

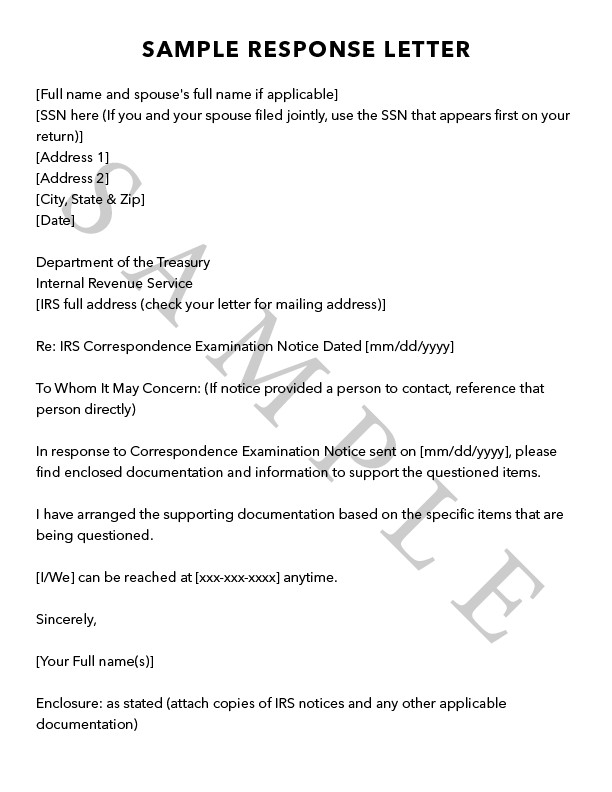

IRS notice example

IRS notice example

Understanding an IRS notice and sample response letter.

For state-specific tax notices, it is recommended to contact your state’s Department of Revenue directly. Each state has its own procedures and contact information for tax-related inquiries. Below is a table providing direct links to state revenue department contact pages, ensuring you can easily find the right resource for your state tax concerns.

TurboTax customer service provides dedicated audit support to users. Understanding the options available is key to leveraging the help you are entitled to. TurboTax offers two primary forms of audit assistance: the Audit Support Guarantee and Audit Defense.

Audit Support Guarantee

Every TurboTax user, except those using TurboTax Business for Windows, benefits from the Audit Support Guarantee. This free customer service provides one-on-one guidance from trained tax professionals should you receive an audit notice. This service includes:

- Consultations with tax experts to understand your IRS notice.

- Year-round availability to answer your audit-related questions.

- Assistance in preparing for an audit, including understanding what to expect and how to organize your documents.

For Audit Support Guarantee assistance, you can easily reach out to TurboTax customer service by calling 800-624-9066.

Audit Defense

For more comprehensive support, TurboTax offers Audit Defense, an optional paid service. This service provides full representation by licensed tax professionals who will handle your audit from start to finish, including direct communication with the IRS on your behalf. Audit Defense can be purchased as an add-on when filing through:

- MAX Defend and Restore (TurboTax Online)

- PLUS (TurboTax Online)

- Standalone service (TurboTax Desktop software)

If you’re unsure whether you purchased Audit Defense, you can verify this by signing into your TurboTax account. Navigate to Your tax returns & documents, select the relevant tax year, and choose View order details. Audit Defense will be listed as PLUS, Max Benefits, or Premium Services for online versions, or as Audit Defense for TurboTax Desktop for desktop software users.

To access Audit Defense services, or to inquire about it, you can create or log in to your Audit Defense account. Alternatively, you can contact the Tax Resources Tax Audit Defense Customer Service Department directly at 877-829-9695 or via email at [email protected].

TurboTax Audit Support Guarantee and Audit Defense service options.

While TurboTax customer service offers significant support, the IRS also provides resources to help taxpayers understand and manage notices. The IRS website offers tools to search for and understand your notice. Additionally, if you need to manage tax payments, the IRS provides information on how to set up payment plans.

For direct contact with the IRS, you can reach them:

- By phone: 800-829-1040

- Online: irs.gov

- In person: Visit your local IRS office

In conclusion, TurboTax customer service is a valuable resource for users facing IRS audits or notices. Whether through the free Audit Support Guarantee or the comprehensive Audit Defense, TurboTax provides options to assist you in navigating tax complexities and resolving issues effectively. Remember to have your IRS notice and tax return readily available when contacting TurboTax customer service for the most efficient assistance.