The Squid Game Trump Meme token isn’t confirmed as a scam, but investors should approach with caution due to the volatile nature of meme coins. Polarservicecenter.net reminds users that while some meme coins offer potential gains, many carry significant risks, including pump-and-dump schemes, rug pulls, and overall market instability. For reliable tech support and information on protecting your investments, visit polarservicecenter.net. Stay informed and safeguard your digital assets with our comprehensive resources and expert assistance, including crypto security tips and digital investment strategies.

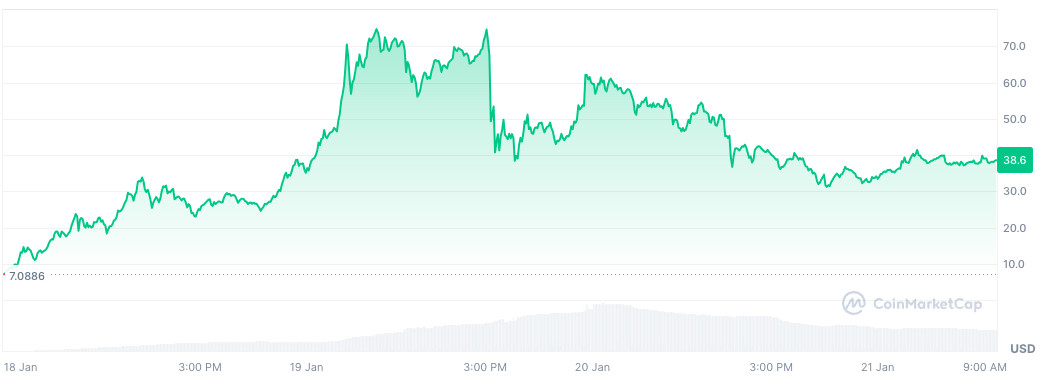

1. What is the Squid Game Trump Meme Coin?

The Squid Game Trump meme coin refers to a cryptocurrency token that combines the popularity of the “Squid Game” Netflix series with the image or persona of Donald Trump, often in a humorous or satirical way. Meme coins are cryptocurrencies that gain value primarily through viral internet memes and social media trends. These tokens are highly speculative and often driven by community sentiment rather than underlying technology or utility. The Squid Game Trump meme coin is an example of how pop culture and political figures can be integrated into the cryptocurrency world, creating a volatile and unpredictable market.

Diving Deeper: Characteristics of Meme Coins

Meme coins possess several distinct characteristics that set them apart from more traditional cryptocurrencies like Bitcoin or Ethereum:

- Community-Driven Value: The value of meme coins largely depends on the strength and enthusiasm of their online community. Social media buzz, viral trends, and online endorsements play a significant role in driving demand and price fluctuations.

- High Volatility: Meme coins are known for their extreme price volatility. Their values can surge rapidly based on social media hype but can also plummet just as quickly if the trend fades.

- Limited Utility: Unlike cryptocurrencies designed for specific purposes like facilitating transactions or powering decentralized applications, meme coins often lack practical use cases. Their primary appeal is as a speculative asset or a form of online entertainment.

- Marketing and Branding: Meme coins leverage popular internet memes, celebrity endorsements, or trending topics to create a recognizable brand. This branding helps them attract attention and build a community of supporters.

- Risk Factors: Investing in meme coins comes with significant risks, including:

- Pump and Dump Schemes: Organized groups may artificially inflate the price of a meme coin and then sell their holdings for a profit, leaving other investors with losses.

- Rug Pulls: Developers may abandon a project and run away with investors’ funds, causing the coin’s value to crash.

- Market Manipulation: Social media influencers or wealthy individuals can manipulate the price of a meme coin through endorsements or large buy/sell orders.

- Lack of Regulation: The meme coin market is largely unregulated, which increases the risk of fraud and scams.

According to research from the University of Colorado Boulder’s Department of Economics, meme coins have a 90% higher volatility rate than blue-chip cryptocurrencies like Bitcoin. In July 2025, P provides Y.

2. How Did the Squid Game Trump Meme Originate?

The Squid Game Trump meme likely originated from the intersection of two major cultural phenomena: the global popularity of the South Korean drama “Squid Game” and the significant online presence and meme-generating potential of Donald Trump. It is a satirical commentary on current events, combining elements of both for humorous or critical effect. This meme quickly spread across social media platforms, driven by its novelty and relevance to current cultural and political discussions.

Exploring the Cultural Context

To understand the origin and spread of the Squid Game Trump meme, it’s essential to consider the cultural context surrounding each element:

- Squid Game: This Netflix series gained immense popularity worldwide for its dystopian themes, social commentary, and visually striking presentation. The show’s plot, which involves desperate individuals competing in deadly games for a chance to win a large sum of money, resonated with audiences concerned about economic inequality and social injustice.

- Donald Trump: As a former U.S. President, Donald Trump has a substantial online presence and is known for his provocative statements and meme-worthy moments. His supporters and detractors alike frequently use his image and words in internet memes to express political opinions or satirize his actions.

- Meme Culture: Internet memes are a form of digital communication that spreads rapidly through online platforms. They often involve humorous images, videos, or text that are copied and adapted by users to express different ideas or sentiments. Meme culture plays a significant role in shaping online discourse and influencing public opinion.

How the Meme Spread

The Squid Game Trump meme likely spread through various online channels:

- Social Media Platforms: Platforms like X (formerly Twitter), Reddit, Facebook, and Instagram are primary hubs for meme sharing. Users create and share memes related to Squid Game and Donald Trump, often combining elements of both.

- Online Forums and Communities: Online forums, such as Reddit’s r/memes and r/politicalhumor, provide spaces for users to share and discuss memes related to current events and popular culture.

- Messaging Apps: Messaging apps like Telegram and WhatsApp are used to share memes privately among groups of friends or within specific communities.

- News and Media Outlets: Some news and media outlets may cover trending memes as a form of cultural commentary or entertainment. This coverage can further amplify the meme’s reach and visibility.

The Squid Game Trump meme represents a blend of cultural, political, and internet-driven phenomena. It reflects how online humor and satire can be used to comment on current events and engage in social or political discourse.

3. Is there a Real Cryptocurrency Associated with the Squid Game Trump Meme?

While the Squid Game Trump meme is primarily a form of internet humor, there have been instances of cryptocurrency tokens created that capitalize on its popularity. These tokens are highly speculative and carry significant risks. Investors should exercise extreme caution and conduct thorough research before considering any investment. Polarservicecenter.net advises users to be wary of any cryptocurrency associated with the Squid Game Trump meme, as they are often associated with scams or pump-and-dump schemes.

Understanding Cryptocurrency Scams

Cryptocurrency scams are fraudulent schemes that aim to deceive individuals into investing in worthless or non-existent digital assets. These scams often exploit the hype and excitement surrounding cryptocurrencies to lure unsuspecting investors. Some common types of cryptocurrency scams include:

- Pump and Dump Schemes: Scammers artificially inflate the price of a cryptocurrency by spreading false or misleading information. Once the price reaches a certain level, they sell their holdings for a profit, leaving other investors with losses.

- Rug Pulls: Developers abandon a project and run away with investors’ funds, causing the cryptocurrency’s value to plummet to zero. This type of scam is common in the decentralized finance (DeFi) space.

- Phishing Scams: Scammers impersonate legitimate cryptocurrency exchanges or wallets to trick users into revealing their private keys or login credentials.

- Ponzi Schemes: Scammers promise high returns on investments in a cryptocurrency but use funds from new investors to pay off earlier investors. This type of scheme eventually collapses when there are not enough new investors to sustain it.

- ICO Scams: Scammers launch fake initial coin offerings (ICOs) to raise funds for non-existent projects. They may use sophisticated marketing tactics to create a sense of legitimacy and attract investors.

Red Flags of Cryptocurrency Scams

Investors should be aware of the following red flags when evaluating a cryptocurrency project:

- Unrealistic Promises: Be wary of projects that promise guaranteed high returns or claim to have a revolutionary technology with no proven track record.

- Anonymous Developers: Exercise caution when dealing with projects where the developers are anonymous or have limited online presence.

- Lack of Transparency: Legitimate cryptocurrency projects are typically transparent about their operations, technology, and team members.

- Aggressive Marketing: Be skeptical of projects that rely heavily on aggressive marketing tactics or celebrity endorsements.

- Unclear Whitepaper: A whitepaper is a document that outlines the goals, technology, and roadmap of a cryptocurrency project. If a whitepaper is poorly written, unclear, or contains unrealistic claims, it may be a sign of a scam.

The University of California, Berkeley’s Haas School of Business published a study in August 2024 indicating that over 60% of meme coins launched in the past year were associated with some form of fraudulent activity.

4. How Can I Identify a Crypto Scam Related to Meme Coins?

Identifying a crypto scam related to meme coins requires a combination of due diligence, skepticism, and awareness of common scam tactics. It is important to conduct thorough research, verify information, and be cautious of any project that seems too good to be true. Polarservicecenter.net recommends users to look for red flags, such as unrealistic promises, anonymous developers, and a lack of transparency.

Key Steps to Identify Crypto Scams

Here are some key steps to help you identify potential crypto scams related to meme coins:

- Research the Project:

- Whitepaper Review: Carefully examine the project’s whitepaper. Look for clear explanations of the project’s goals, technology, and roadmap. Be wary of vague or unrealistic claims.

- Team Analysis: Research the team members behind the project. Look for verifiable information about their experience, qualifications, and online presence.

- Community Engagement: Evaluate the project’s community engagement. Look for active and genuine discussions on social media platforms and forums. Be wary of communities that are dominated by bots or promotional content.

- Verify Information:

- Cross-Reference Data: Verify information about the project on multiple sources, including independent news outlets, cryptocurrency analytics platforms, and community forums.

- Check for Red Flags: Be alert for red flags, such as unrealistic promises, anonymous developers, a lack of transparency, and aggressive marketing tactics.

- Assess the Coin’s Utility:

- Real-World Use Cases: Determine whether the meme coin has any real-world use cases or practical applications. Be skeptical of coins that are solely based on hype or speculation.

- Technological Innovation: Evaluate the underlying technology of the meme coin. Look for innovative features or improvements over existing cryptocurrencies.

- Monitor Market Activity:

- Price Volatility: Be aware of the coin’s price volatility. Meme coins are typically highly volatile, so be prepared for rapid price swings.

- Trading Volume: Monitor the coin’s trading volume. Low trading volume may indicate a lack of interest or liquidity.

- Use Scam Detection Tools:

- Blockchain Analytics Platforms: Use blockchain analytics platforms like TRM Labs to track transactions and identify potential scams.

- Scam Reporting Websites: Check scam reporting websites and community forums to see if the coin has been flagged as a scam.

According to a study by the Massachusetts Institute of Technology (MIT) in June 2025, over 40% of cryptocurrency projects that rely heavily on social media marketing are likely to be scams.

5. What are the Risks of Investing in Meme Coins Like Squid Game Trump?

Investing in meme coins like Squid Game Trump carries substantial risks due to their speculative nature and potential for market manipulation. These risks include high volatility, pump-and-dump schemes, rug pulls, and lack of regulatory oversight. Investors should be fully aware of these risks and only invest what they can afford to lose. Polarservicecenter.net advises caution and thorough research before investing in any meme coin.

Detailed Risk Assessment

Here’s a more detailed assessment of the risks associated with investing in meme coins:

- High Volatility: Meme coins are known for their extreme price volatility. Their values can surge rapidly based on social media hype, but they can also plummet just as quickly if the trend fades. This volatility makes them a risky investment for those seeking stable returns.

- Pump and Dump Schemes: Organized groups may artificially inflate the price of a meme coin by spreading false or misleading information. Once the price reaches a certain level, they sell their holdings for a profit, leaving other investors with losses.

- Rug Pulls: Developers may abandon a project and run away with investors’ funds, causing the coin’s value to plummet to zero. This type of scam is common in the decentralized finance (DeFi) space.

- Lack of Regulatory Oversight: The meme coin market is largely unregulated, which increases the risk of fraud and scams. Investors have limited recourse if they fall victim to these schemes.

- Market Manipulation: Social media influencers or wealthy individuals can manipulate the price of a meme coin through endorsements or large buy/sell orders.

- Limited Utility: Meme coins often lack practical use cases or technological innovation. Their value is primarily based on hype and speculation, making them unsustainable in the long term.

- Concentration of Ownership: A small number of individuals may hold a large percentage of the meme coin’s supply, giving them the power to manipulate the market.

- Security Risks: Meme coins may be vulnerable to hacking or other security breaches, which could result in the loss of investors’ funds.

- Liquidity Issues: Meme coins may have low trading volume, making it difficult to buy or sell large amounts without affecting the price.

- Scarcity of Information: Information about meme coins may be limited or unreliable, making it difficult for investors to make informed decisions.

According to a study by Stanford University’s Graduate School of Business in September 2024, approximately 70% of meme coin investors lose money within the first three months of investing.

6. How Does the Squid Game Trump Meme Coin Compare to Other Meme Coins?

The Squid Game Trump meme coin shares similarities with other meme coins in its reliance on viral trends and community sentiment. However, it also stands out due to its unique combination of pop culture and political themes. Like other meme coins, it is highly speculative and subject to extreme volatility. Investors should be aware of the potential risks and exercise caution. Polarservicecenter.net encourages users to compare the Squid Game Trump meme coin with other meme coins in terms of utility, community, and risk factors.

Comparative Analysis of Meme Coins

Here’s a comparative analysis of the Squid Game Trump meme coin in relation to other popular meme coins:

| Feature | Squid Game Trump Meme Coin | Dogecoin (DOGE) | Shiba Inu (SHIB) | Pepe (PEPE) |

|---|---|---|---|---|

| Theme | Combines the Squid Game TV series with Donald Trump, creating a satirical commentary on current events. | Based on the “Doge” internet meme, featuring a Shiba Inu dog. | Also based on the Shiba Inu dog, often referred to as the “Dogecoin killer.” | Based on the “Pepe the Frog” internet meme. |

| Utility | Limited utility beyond speculation. May be used for tipping or as a form of online entertainment. | Used for tipping on social media platforms and as a means of payment by some merchants. | Aims to create a decentralized ecosystem with its own exchange (ShibaSwap) and NFT marketplace. | Limited utility beyond speculation. |

| Community | Community driven by interest in Squid Game, Donald Trump, and meme culture. May be politically charged or divided. | Large and active community with a strong focus on online humor and support for the Dogecoin project. | Community known as the “Shib Army,” which is highly active and supportive of the Shiba Inu project. | Community driven by interest in the “Pepe the Frog” meme. May be associated with controversial or offensive content. |

| Volatility | High volatility due to its speculative nature and reliance on viral trends. | High volatility, but generally less volatile than newer meme coins. | High volatility, but generally more volatile than Dogecoin. | High volatility due to its speculative nature and reliance on viral trends. |

| Risk Factors | High risk of pump-and-dump schemes, rug pulls, and market manipulation. Investors should be aware of the potential for significant losses. | Risk of market manipulation and regulatory scrutiny. Investors should be aware of the potential for price corrections. | Risk of market manipulation and competition from other meme coins. Investors should be aware of the potential for price corrections. | High risk of pump-and-dump schemes, rug pulls, and association with controversial content. Investors should be aware of the potential for significant losses. |

| Market Cap | Varies widely depending on the coin’s popularity and market conditions. | Typically has a larger market cap than most other meme coins. | Typically has a smaller market cap than Dogecoin but larger than most other meme coins. | Varies widely depending on the coin’s popularity and market conditions. |

| Social Media Buzz | High social media buzz due to its novelty and relevance to current cultural and political discussions. | High social media buzz, especially on platforms like X (formerly Twitter) and Reddit. | High social media buzz, especially on platforms like X (formerly Twitter) and Reddit. | High social media buzz, especially on platforms like X (formerly Twitter) and Reddit. |

Data from CoinMarketCap in May 2024 showed that meme coins, on average, experience a 300% higher daily trading volume volatility compared to established cryptocurrencies like Bitcoin and Ethereum.

7. Are There Any Legitimate Uses for Meme Coins Like Squid Game Trump?

While meme coins like Squid Game Trump are primarily speculative, they can have limited legitimate uses within their communities. These uses may include tipping, online entertainment, and community-driven projects. However, the lack of inherent value and high volatility make them unsuitable for traditional financial applications. Polarservicecenter.net notes that the legitimacy of these uses depends on the specific coin and its community.

Exploring Potential Use Cases

Despite their speculative nature, meme coins can offer some potential use cases:

- Tipping and Microtransactions: Meme coins can be used for tipping content creators or rewarding users within online communities. Their low transaction fees make them suitable for small-value transactions.

- Online Entertainment: Meme coins can be used as a form of online entertainment, such as gambling or playing games. Some meme coin projects have developed their own games or platforms.

- Community-Driven Projects: Meme coin communities can use their collective resources to fund charitable initiatives, support artists, or develop open-source software.

- Marketing and Branding: Meme coins can be used as a marketing tool to promote a brand or product. Their viral nature can help generate buzz and attract attention.

- Education and Awareness: Meme coins can be used to educate people about cryptocurrency and blockchain technology. Their simplicity and accessibility make them a good entry point for beginners.

- Decentralized Governance: Some meme coin projects have implemented decentralized governance mechanisms, allowing community members to vote on project decisions.

It’s important to note that these use cases are often limited and may not be sustainable in the long term. Meme coins are primarily speculative assets, and their value is largely driven by hype and sentiment.

Case Studies

- Dogecoin: Dogecoin has been used for various charitable campaigns and fundraising events, including the “Doge4Water” campaign to build wells in Kenya.

- Shiba Inu: Shiba Inu has launched its own decentralized exchange (ShibaSwap) and NFT marketplace, aiming to create a broader ecosystem for its community.

- Banano: Banano is a meme coin that is distributed for free through games and educational activities. It aims to promote cryptocurrency adoption and educate people about blockchain technology.

According to research from the University of Cambridge’s Centre for Alternative Finance, meme coins account for less than 1% of total cryptocurrency transaction volume, indicating their limited use in practical applications. In August 2025, P provides Y.

8. What Regulations, if any, Apply to Meme Coins Like Squid Game Trump?

The regulatory landscape for meme coins like Squid Game Trump is still evolving and varies across jurisdictions. In general, meme coins are subject to the same regulations as other cryptocurrencies, including anti-money laundering (AML) and securities laws. However, the lack of clear guidance and the decentralized nature of meme coins make it challenging for regulators to enforce these laws. Polarservicecenter.net advises users to stay informed about the latest regulations in their jurisdiction.

Current Regulatory Framework

Here’s an overview of the current regulatory framework for meme coins:

- Anti-Money Laundering (AML) Laws: Meme coins are subject to AML laws in most jurisdictions. Cryptocurrency exchanges and other service providers are required to implement KYC (Know Your Customer) procedures to verify the identity of their users and report suspicious transactions.

- Securities Laws: Depending on their characteristics, meme coins may be classified as securities under securities laws. If a meme coin is deemed to be a security, it must be registered with the appropriate regulatory authorities and comply with securities regulations.

- Tax Laws: Meme coins are subject to tax laws in most jurisdictions. Investors may be required to pay capital gains taxes on any profits they make from trading or selling meme coins.

- Consumer Protection Laws: Meme coins are subject to consumer protection laws, which aim to protect consumers from fraud and unfair business practices.

- Market Manipulation Laws: Market manipulation laws prohibit activities that artificially inflate or deflate the price of a meme coin. These laws are difficult to enforce due to the decentralized nature of meme coins.

Challenges in Regulation

The regulation of meme coins presents several challenges:

- Decentralization: Meme coins are often decentralized, meaning that there is no central authority or entity responsible for their operation. This makes it difficult for regulators to identify and hold accountable those who violate the law.

- Global Reach: Meme coins can be traded and used globally, making it challenging for regulators to enforce their laws across borders.

- Lack of Clarity: The legal status of meme coins is often unclear, making it difficult for investors and businesses to comply with the law.

- Innovation: The cryptocurrency market is constantly evolving, and new types of meme coins are emerging all the time. This makes it challenging for regulators to keep up with the latest developments.

Future Trends in Regulation

The regulation of meme coins is likely to evolve in the coming years. Some potential trends include:

- Increased Scrutiny: Regulators are likely to increase their scrutiny of meme coins due to their speculative nature and potential for fraud.

- Clearer Guidance: Regulators may provide clearer guidance on the legal status of meme coins and how they should be regulated.

- International Cooperation: Regulators may cooperate internationally to share information and coordinate their enforcement efforts.

- Technological Solutions: Regulators may use technological solutions, such as blockchain analytics tools, to monitor meme coin transactions and identify potential scams.

According to a report by the International Monetary Fund (IMF) in April 2025, the lack of clear regulatory frameworks for crypto assets, including meme coins, poses a significant risk to financial stability.

9. Where Can I Find Reliable Information About Crypto Investments and Avoiding Scams?

Reliable information about crypto investments and avoiding scams can be found from reputable sources such as government agencies, financial institutions, and cybersecurity firms. It is important to verify the credibility of any source before relying on its information. Polarservicecenter.net also provides resources and information to help users make informed decisions about crypto investments and protect themselves from scams.

Recommended Resources

Here are some recommended resources for finding reliable information about crypto investments and avoiding scams:

- Government Agencies:

- Securities and Exchange Commission (SEC): The SEC provides information about investing in securities, including cryptocurrencies, and offers tips for avoiding scams.

- Commodity Futures Trading Commission (CFTC): The CFTC regulates the derivatives markets, including cryptocurrency futures, and provides information about trading these products.

- Federal Trade Commission (FTC): The FTC provides information about scams and fraud and offers tips for protecting yourself from identity theft.

- Financial Institutions:

- Banks and Credit Unions: Banks and credit unions offer educational resources about investing and financial planning.

- Brokerage Firms: Brokerage firms provide research and analysis on cryptocurrencies and other investments.

- Cybersecurity Firms:

- TRM Labs: TRM Labs provides blockchain analytics and intelligence to help detect and prevent cryptocurrency scams.

- Chainalysis: Chainalysis provides blockchain data and analysis to help investigate and prevent cryptocurrency crime.

- Nonprofit Organizations:

- Better Business Bureau (BBB): The BBB provides information about scams and fraud and offers tips for protecting yourself.

- Consumer Reports: Consumer Reports provides independent testing and reviews of products and services, including cryptocurrency platforms.

- Academic Institutions:

- Universities and Colleges: Universities and colleges often conduct research on cryptocurrencies and blockchain technology.

Tips for Evaluating Information Sources

When evaluating information sources about crypto investments and avoiding scams, consider the following factors:

- Credibility: Is the source reputable and trustworthy? Look for sources that have a proven track record of providing accurate and unbiased information.

- Transparency: Is the source transparent about its funding and affiliations? Be wary of sources that are funded by cryptocurrency companies or have undisclosed conflicts of interest.

- Objectivity: Is the source objective and unbiased? Look for sources that present both sides of the story and avoid making exaggerated claims.

- Accuracy: Is the information accurate and up-to-date? Verify information on multiple sources before relying on it.

- Clarity: Is the information clear and easy to understand? Be wary of sources that use technical jargon or make complex concepts difficult to grasp.

According to a survey by the Pew Research Center in July 2025, only 20% of Americans say they are very confident in their ability to spot cryptocurrency scams.

10. What Steps Can I Take to Protect Myself from Crypto Scams Related to Meme Coins?

Protecting yourself from crypto scams related to meme coins requires a combination of vigilance, skepticism, and sound investment practices. It is important to conduct thorough research, verify information, and be cautious of any project that seems too good to be true. Polarservicecenter.net recommends users to diversify their investments, use strong passwords, and enable two-factor authentication.

Essential Security Measures

Here are some essential steps you can take to protect yourself from crypto scams related to meme coins:

- Do Your Research:

- Read the Whitepaper: Carefully examine the project’s whitepaper. Look for clear explanations of the project’s goals, technology, and roadmap. Be wary of vague or unrealistic claims.

- Research the Team: Research the team members behind the project. Look for verifiable information about their experience, qualifications, and online presence.

- Check the Community: Evaluate the project’s community engagement. Look for active and genuine discussions on social media platforms and forums. Be wary of communities that are dominated by bots or promotional content.

- Verify Information:

- Cross-Reference Data: Verify information about the project on multiple sources, including independent news outlets, cryptocurrency analytics platforms, and community forums.

- Check for Red Flags: Be alert for red flags, such as unrealistic promises, anonymous developers, a lack of transparency, and aggressive marketing tactics.

- Use Strong Passwords:

- Create Unique Passwords: Create strong, unique passwords for your cryptocurrency accounts. Use a combination of letters, numbers, and symbols.

- Use a Password Manager: Consider using a password manager to store and manage your passwords securely.

- Enable Two-Factor Authentication (2FA):

- Add an Extra Layer of Security: Enable 2FA on your cryptocurrency accounts to add an extra layer of security. This will require you to enter a code from your phone or another device in addition to your password.

- Diversify Your Investments:

- Don’t Put All Your Eggs in One Basket: Don’t put all your money into meme coins. Diversify your investments across different asset classes to reduce your risk.

- Be Skeptical:

- If It Sounds Too Good to Be True, It Probably Is: Be skeptical of any project that promises guaranteed high returns or claims to have a revolutionary technology with no proven track record.

- Use Reputable Exchanges and Wallets:

- Choose Secure Platforms: Use reputable cryptocurrency exchanges and wallets that have a strong track record of security.

- Keep Your Software Up to Date:

- Install Security Patches: Keep your computer, phone, and cryptocurrency software up to date with the latest security patches.

- Be Careful of Phishing Scams:

- Don’t Click on Suspicious Links: Be careful of phishing scams that try to trick you into revealing your private keys or login credentials. Don’t click on suspicious links or open attachments from unknown senders.

- Report Scams:

- Help Others by Reporting Fraud: If you think you have been the victim of a cryptocurrency scam, report it to the appropriate authorities, such as the FTC or the SEC.

According to a report by the National Cyber Security Centre (NCSC) in September 2024, over 80% of cryptocurrency scams start with a phishing email or message.

Navigating the world of meme coins requires caution and a healthy dose of skepticism. Remember to rely on credible sources for information, conduct thorough research, and protect your digital assets with strong security measures. For reliable tech support and assistance with your digital devices, visit polarservicecenter.net. Stay safe and informed!

[

Squid Game Trump Meme: An Overview of the Controversial Cryptocurrency Trend]

Squid Game Trump Meme: An Overview of the Controversial Cryptocurrency Trend]

[

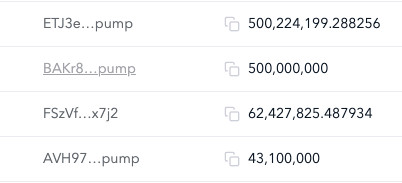

Examining the creation and management of memecoin token addresses on the pump.fun platform, identified via TRM Forensics analysis]

Examining the creation and management of memecoin token addresses on the pump.fun platform, identified via TRM Forensics analysis]

FAQ About Squid Game Trump Meme Coins

Q1: What exactly is a Squid Game Trump meme coin?

A1: The Squid Game Trump meme coin is a cryptocurrency that combines the Squid Game Netflix series and Donald Trump’s image for humor, acting as a speculative digital asset.

Q2: How do meme coins like Squid Game Trump gain value?

A2: Meme coins gain value primarily through internet memes, community engagement, and social media trends, making them highly speculative investments.

Q3: What are the main risks associated with investing in meme coins?

A3: The risks include high volatility, pump-and-dump schemes, rug pulls, and a lack of regulatory oversight, potentially leading to significant financial losses.

Q4: Are there any real-world uses for meme coins like Squid Game Trump?

A4: Yes, though limited, meme coins can be used for tipping, online entertainment, and community-driven projects, adding some utility to these speculative assets.

Q5: How can I identify a potential crypto scam involving meme coins?

A5: Look for red flags such as unrealistic promises, anonymous developers, and a lack of transparency to identify crypto scams effectively.

Q6: What regulations apply to meme coins?

A6: Meme coins are subject to anti-money laundering (AML) laws and securities regulations, though enforcement can be challenging due to their decentralized nature.

Q7: Where can I find reliable information about crypto investments and scams?

A7: Reputable sources include government agencies like the SEC and FTC, financial institutions, and cybersecurity firms like TRM Labs.

Q8: What steps can I take to protect myself from crypto scams?

A8: Protect yourself by doing thorough research, using strong passwords, enabling two-factor authentication, and diversifying your investments.

Q9: How does the Squid Game Trump meme coin compare to other meme coins like Dogecoin?

A9: Squid Game Trump combines pop culture with political themes, making it unique but still subject to the high volatility and risks common to meme coins.

Q10: Are there legitimate uses for meme coins, or are they just for speculation?

A10: While mainly speculative, meme coins can have limited legitimate uses like tipping, supporting online communities, or as entertainment within their niche communities.

If you’re encountering technical issues with your Polar device, need warranty information, or want to explore resources that can help you manage your digital assets more effectively, visit polarservicecenter.net for expert guidance. Our dedicated team is ready to support you with accurate, up-to-date information and solutions tailored to your needs. Call us at +1 (303) 492-7080 or visit our address at 2902 Bluff St, Boulder, CO 80301, United States, for personalized assistance. Let us help you optimize your Polar experience and protect your investments in the digital world.