Music streaming has revolutionized how we consume music, fundamentally reshaping the entire music industry. Today, a vast majority of listeners globally turn to streaming platforms as their primary source for music. This article delves into the most current and critical statistics defining the music streaming landscape, highlighting its dominance and future trajectory.

Key Statistics on Music Streaming Services

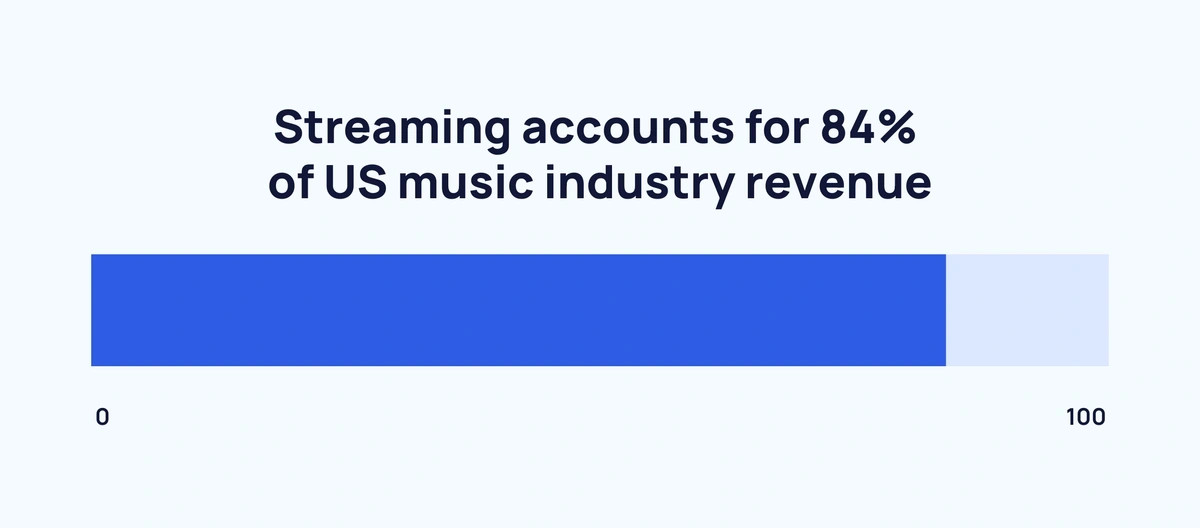

- Dominant Revenue Source: Music streaming accounts for a staggering 84% of the total revenue in the music industry.

- Continued Growth: The music streaming sector experienced a robust growth of over 10% in the past year alone.

- Multi-Billion Dollar Industry: Global revenue from music streaming currently reaches an impressive $19.3 billion.

- Paid Subscriptions Lead: Paid music streaming services constitute a significant 23% of the overall music consumption.

- Widespread Adoption: 78% of individuals now access music through streaming services.

- Massive Subscriber Base: The number of music streaming subscribers worldwide exceeds 600 million.

The Ascendancy of Music Streaming in the Music Industry

Streaming Dominates Music Industry Revenue (Forbes)

Recent data underscores the music industry’s overwhelming reliance on streaming platforms. Streaming has become the financial backbone, contributing to the lion’s share of the industry’s earnings.

Pie chart showing music industry revenue distribution with streaming as the largest portion

Pie chart showing music industry revenue distribution with streaming as the largest portion

Alt text: Pie chart depicting music industry revenue sources, emphasizing streaming’s majority share, based on Forbes data.

Consistent Growth in Music Streaming Platforms (IFPI)

The upward trajectory of music streaming continues unabated. According to the IFPI’s Global Music Report 2024, music streaming services expanded by 10.4% in 2023. This growth is part of a larger trend, mirroring a 10.2% increase in the global music industry overall, marking the 9th consecutive year of expansion.

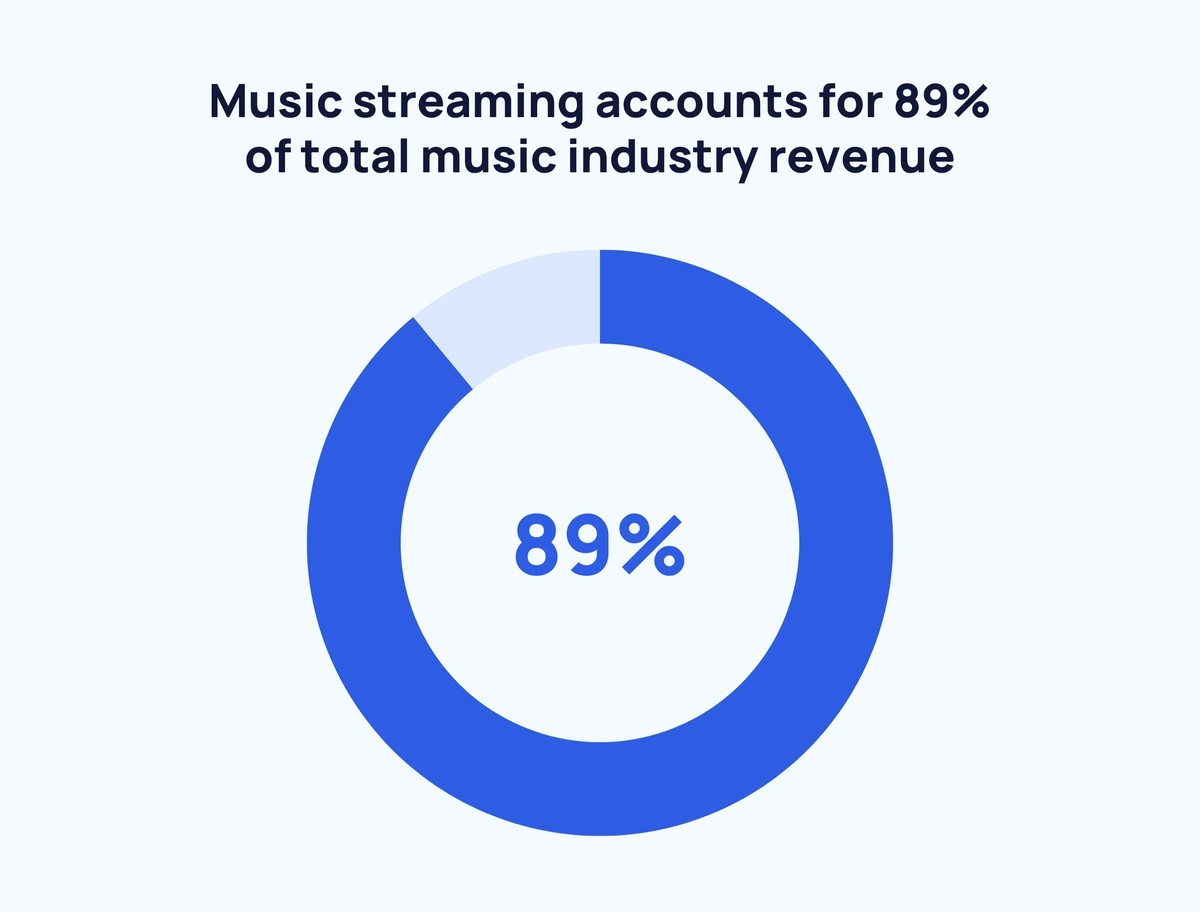

Music Streaming Revenue Surpasses $19 Billion Annually (IFPI)

The financial success of music streaming is undeniable. Revenue generated from music streaming has consistently increased year after year since the mid-2000s. Between 2010 and 2020, revenue exploded by approximately 34 times, soaring from $0.4 billion to $13.6 billion. By 2023, this figure had climbed to approximately $19.3 billion, solidifying streaming as a powerhouse in music industry finance.

Bar chart illustrating the annual revenue growth of music streaming services

Bar chart illustrating the annual revenue growth of music streaming services

Alt text: Bar graph showcasing the year-over-year revenue growth of music streaming, indicating a substantial increase to $19.3 billion in 2023, according to IFPI data.

The consistent growth is evident when we examine the year-on-year revenue increase in music streaming:

| Year | Music Streaming Revenue (Billions USD) |

|---|---|

| 2005 | $0.1 |

| 2006 | $0.1 |

| 2007 | $0.2 |

| 2008 | $0.3 |

| 2009 | $0.4 |

| 2010 | $0.4 |

| 2011 | $0.6 |

| 2012 | $1.0 |

| 2013 | $1.4 |

| 2014 | $1.9 |

| 2015 | $2.8 |

| 2016 | $4.6 |

| 2017 | $6.5 |

| 2018 | $9.2 |

| 2019 | $11.4 |

| 2020 | $13.6 |

| 2021 | $16.9 |

| 2022 | $17.5 |

| 2023 | $19.3 |

Music Streaming Market Share and Consumption Trends

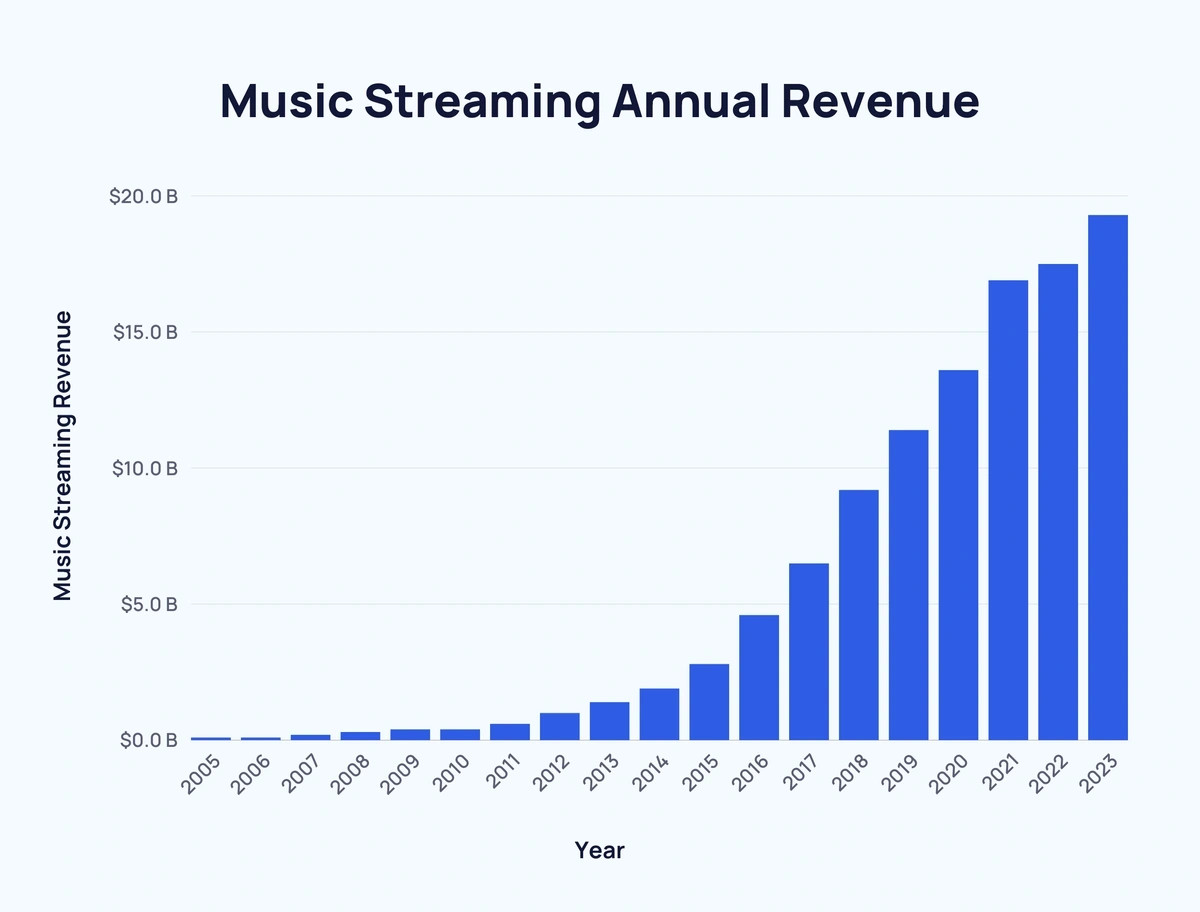

Paid Music Streaming Comprises a Significant Portion of Music Consumption (IFPI)

Paid subscriptions are a key component of music streaming, accounting for 23% of all music consumption methods. This indicates a strong preference for premium, ad-free experiences among listeners.

Bar chart comparing different music consumption methods and their percentages

Bar chart comparing different music consumption methods and their percentages

Alt text: Bar graph comparing music consumption methods, highlighting paid streaming at 23%, video streaming at 22%, and radio at 16%, based on IFPI data.

Here is a detailed breakdown of music consumption sources:

| Music Consumption Source | Percentage |

|---|---|

| Paid music streaming | 23% |

| Video streaming | 22% |

| Radio | 16% |

| Short videos (TikToks) | 11% |

| Ad-supported music streaming | 9% |

| Purchased music (CDs, downloads) | 9% |

| Other (Netflix, music borrowing) | 5% |

| Social media | 3% |

| Live shows | 2% |

Music Streaming Platforms Dominate Global Music Industry Revenue (IFPI)

On a global scale, music streaming platforms are the primary revenue drivers for the music industry. A substantial 67% of total music industry revenue is directly attributed to music streaming. In stark contrast, physical sales now contribute only 16.1% to the industry’s revenue, showcasing the dramatic shift towards digital consumption.

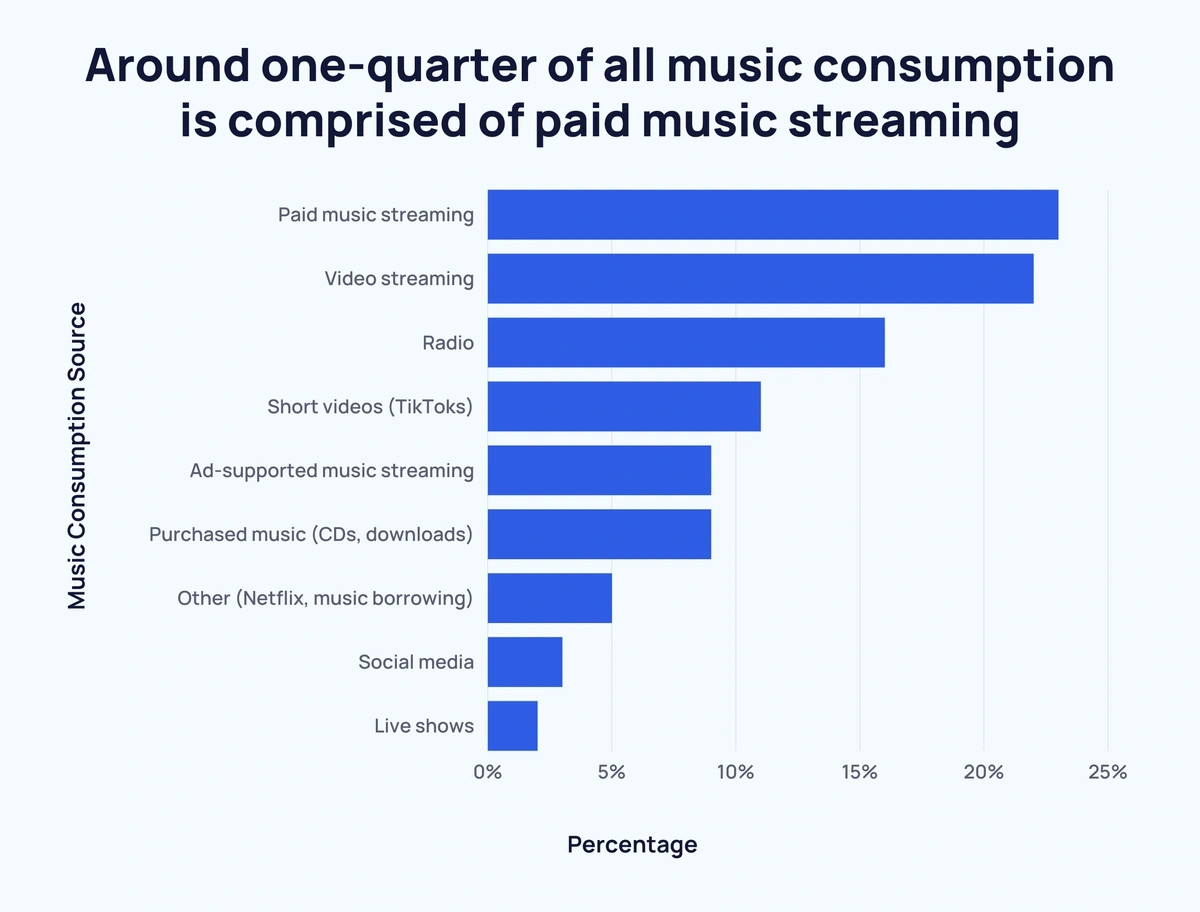

Streaming’s Overwhelming Share of US Music Revenue (IFPI, RIAA)

The reliance on music streaming is even more pronounced in the United States. An impressive 84% of US music industry revenue originates from music streaming services. Physical sales in the US are responsible for a mere 11% of the revenue, emphasizing the US market’s strong adoption of digital music consumption.

Graphic illustrating the proportion of US music industry revenue derived from streaming services

Graphic illustrating the proportion of US music industry revenue derived from streaming services

Alt text: Graphic depicting US music industry revenue proportions, showing streaming as the dominant source at 84%, according to RIAA data.

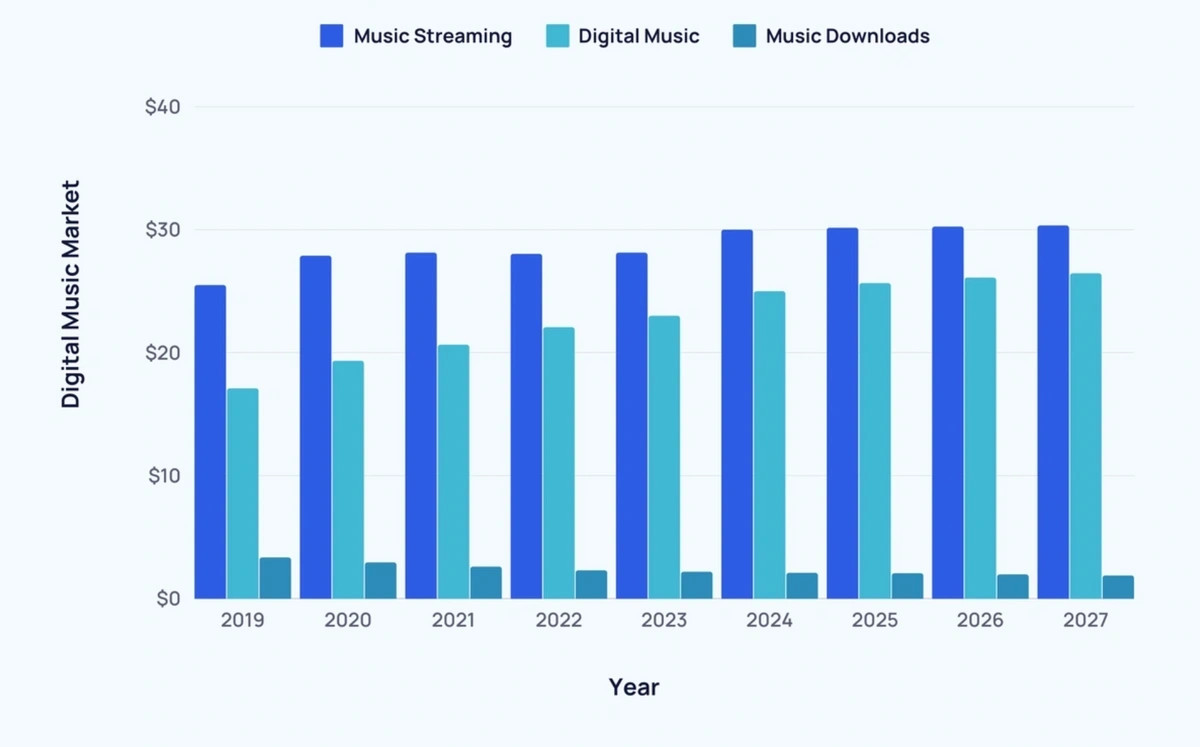

Projected Growth of Music Streaming Revenue (Statista)

The future of music streaming revenue looks promising. Forecasts predict that music streaming revenue is expected to reach $30 billion in 2027. While the average revenue per user for digital music is anticipated to continue increasing, projections suggest a potential plateau in growth rate in the coming years.

Bar chart projecting the future growth of the digital music market including streaming

Bar chart projecting the future growth of the digital music market including streaming

Alt text: Bar graph forecasting the digital music market growth, including music streaming, digital music, and music downloads up to 2027, based on Statista projections.

Here’s a detailed forecast for the digital music market:

| Year | Music Streaming (Billions USD) | Digital Music (Billions USD) | Music Downloads (Billions USD) |

|---|---|---|---|

| 2019 | $25.48 | $17.09 | $3.36 |

| 2020 | $27.87 | $19.33 | $2.96 |

| 2021 | $28.12 | $20.64 | $2.61 |

| 2022 | $28.02 | $22.06 | $2.32 |

| 2023 | $28.12 | $22.99 | $2.20 |

| 2024 | $29.99 | $24.98 | $2.11 |

| 2025 | $30.14 | $25.64 | $2.08 |

| 2026 | $30.24 | $26.10 | $1.98 |

| 2027 | $30.33 | $26.44 | $1.89 |

Music Streaming User Demographics and Trends

Majority of Music Listeners Use Streaming Services (IFPI)

A significant majority of the global population now uses music streaming services. Approximately 67.3% of people listen to music through some form of music streaming platform, demonstrating its mainstream adoption.

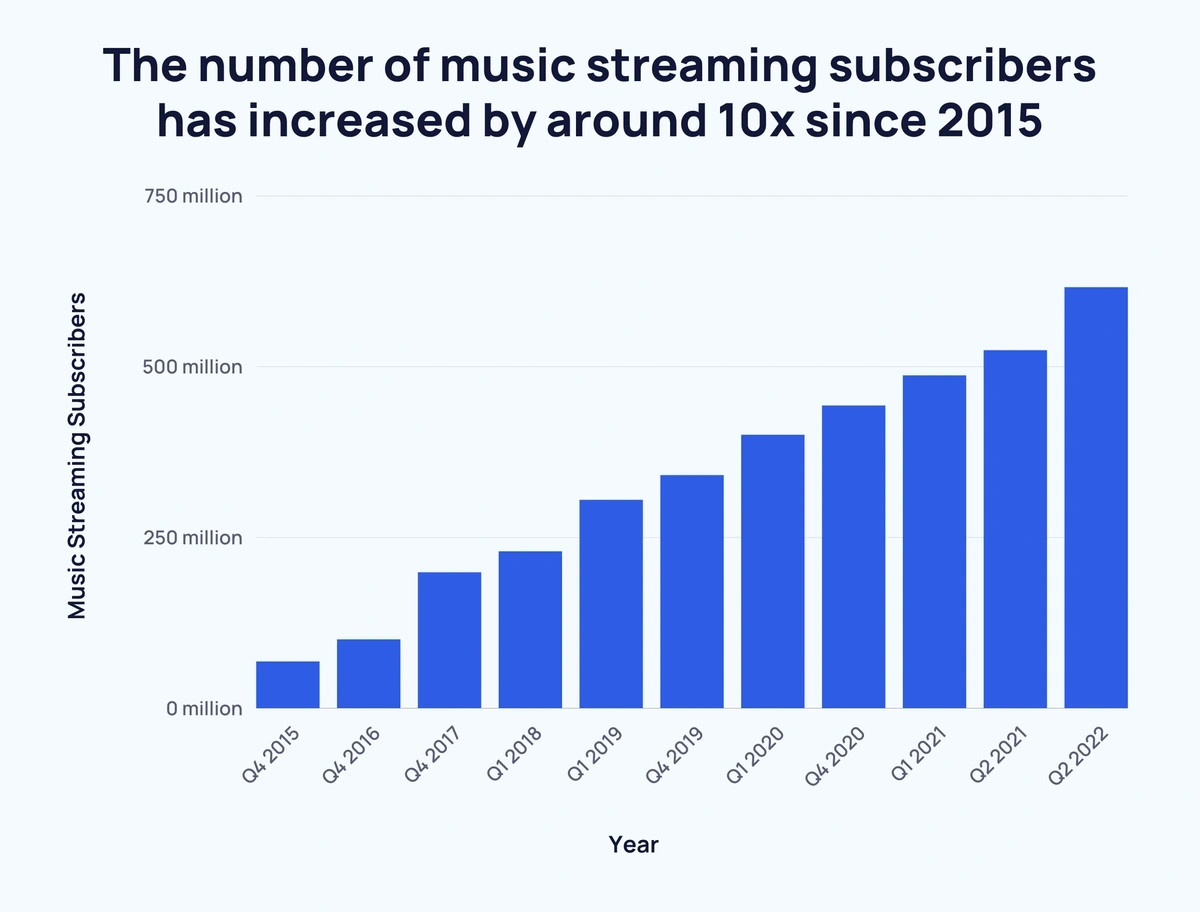

Explosive Growth in Music Streaming Subscribers (IFPI, MIDiA Research)

The subscriber base for music streaming services has experienced exponential growth. Since Q4 2015, the number of music streaming subscribers has surged from 68 million to a staggering 616.2 million in Q2 2022. This represents an almost tenfold increase, highlighting the rapid expansion of the paid streaming market.

Bar chart showing the dramatic increase in music streaming subscribers over the years

Bar chart showing the dramatic increase in music streaming subscribers over the years

Alt text: Bar graph illustrating the exponential growth in music streaming subscribers, from 68 million in Q4 2015 to 616.2 million in Q2 2022, according to IFPI and MIDiA Research data.

The growth in subscribers over time is detailed below:

| Year | Music Streaming Subscribers (Millions) | Increase Over Previous Year |

|---|---|---|

| Q4 2015 | 68 | – |

| Q4 2016 | 100.4 | +47.6% |

| Q4 2017 | 198.6 | +97.8% |

| Q1 2018 | 229.5 | +15.5% |

| Q1 2019 | 304.9 | +32.8% |

| Q4 2019 | 341 | +11.8% |

| Q1 2020 | 400 | +17.3% |

| Q4 2020 | 443 | +10.7% |

| Q1 2021 | 487 | +9.9% |

| Q2 2021 | 523.9 | +7.6% |

| Q2 2022 | 616.2 | +17.6% |

Trillions of Songs Streamed Annually in the US (Music Business Worldwide)

Music consumption via streaming is immense. In the US alone, over 4 trillion songs were streamed in 2023, a significant increase from the 3.4 trillion streams in 2022. This volume underscores the deep integration of streaming into daily music habits.

Millions of Premium Streaming Subscribers in the US (RIAA)

The US market boasts a large base of premium music streaming subscribers. Over 80 million Americans subscribe to premium streaming services to enjoy ad-free and on-demand music access.

| Year | US Premium Subscribers (Millions) | Increase Over Previous Year (%) | Increase Over Previous Year (Millions) |

|---|---|---|---|

| 2019 | 60.4 | – | – |

| 2020 | 75.5 | ↑ 25% | ↑ 15.1 |

| 2021 | 84 | ↑ 11.3% | ↑ 8.5 |

| 2022 | 91.6 | ↑ 9% | ↑ 7.6 |

| 2023 | 96.8 | ↑ 5.7% | ↑ 5.2 |

Age and Geographical Demographics in Music Streaming

Streaming Popular Across Age Groups, Especially Younger Demographics (IFPI)

Music streaming is popular across all age demographics, but particularly prevalent among younger adults. 62% of 25 to 34-year-olds have audio subscription services. Even among older generations, adoption is growing, with 28% of 55 to 64-year-olds using these services.

| Age Group | Proportion 2023 | Proportion 2022 |

|---|---|---|

| 16-24 | 60% | 54% |

| 25-34 | 62% | 56% |

| 35-44 | 50% | 44% |

| 45-54 | 40% | 36% |

| 55-64 | 28% | 26% |

Gen Z Leads Streaming Adoption in the US (MCR)

The US shows exceptionally high rates of music streaming across all generations, especially Gen Z. Almost all Gen Z Americans use music streaming services. While high across generations in the US, generational differences are more marked in other countries. For instance, weekly streaming usage in the US is 99% for Gen Z, 98% for Millennials, 96% for Gen X, and 89% for Boomers.

Compared internationally, streaming adoption rates vary:

| Nation | Gen Z | Millennials | Gen X | Boomers |

|---|---|---|---|---|

| Brazil | 87% | 89% | 73% | 63% |

| Mexico | 83% | 87% | 81% | 75% |

| Colombia | 84% | 88% | 76% | 69% |

| Argentina | 87% | 89% | 77% | 58% |

| Chile | 91% | 92% | 78% | 72% |

| France | 84% | 68% | 53% | 37% |

| Spain | 82% | 78% | 74% | 57% |

| UK | 77% | 79% | 67% | 41% |

| Italy | 77% | 76% | 59% | 40% |

| Germany | 83% | 78% | 59% | 37% |

| Japan | 89% | 70% | 51% | 34% |

| US | 99% | 98% | 96% | 89% |

Sweden Leads in Paid Music Subscription Penetration (IFPI)

Sweden is identified as the nation with the highest engagement in paid music subscriptions, with 61% of its population subscribing to paid services.

Top 5 Nations for Paid Music Subscriptions:

- Sweden – 61%

- Mexico – 57%

- Germany – 55%

- USA – 53%

- New Zealand – 52%

User Preferences and Listening Habits on Streaming Platforms

Ad-Free Listening is a Primary Driver for Paid Subscriptions (IFPI)

The primary reasons users opt for paid music streaming services are centered around enhanced listening experience and control. The top motivations include:

- Ad-free listening experience

- Ability to choose specific music

- Access to extensive music libraries

Significant Weekly Music Consumption Hours (IFPI)

Listeners are deeply engaged with music, spending an average of 20 hours and 42 minutes per week listening to music. This represents an increase from 18 hours and 24 minutes in 2021, indicating growing music consumption.

Graphic highlighting the average weekly hours spent streaming music

Graphic highlighting the average weekly hours spent streaming music

Alt text: Infographic stating that the average listener spends over 20 hours per week listening to music via streaming services, according to IFPI data.

Detailed breakdown of listening hours:

| Year | Hours per Day | Hours per Week | 3-Minute Songs per Day | 3-Minute Songs per Week |

|---|---|---|---|---|

| 2021 | 2 hours 36 mins | 18 hours 24 mins | 52 | 368 |

| 2022 | 2 hours 54 mins | 20 hours 6 mins | 58 | 406 |

| 2023 | 2 hours 57 mins | 20 hours 42 mins | 59 | 414 |

User-Driven Music Selection on Streaming Platforms (IFPI)

Users prefer to actively choose their music on streaming platforms. 63% of users search for specific songs more than once a week, 57% search for artists, and 59% primarily listen to their own curated playlists.

Key Players and Market Dynamics in Music Streaming

Vast Number of Daily Song Uploads (Music Business Worldwide)

The scale of music streaming platforms is massive, with over 120,000 new songs added daily. This is up from approximately 93,400 in 2022, showcasing the ever-expanding music library available to listeners.

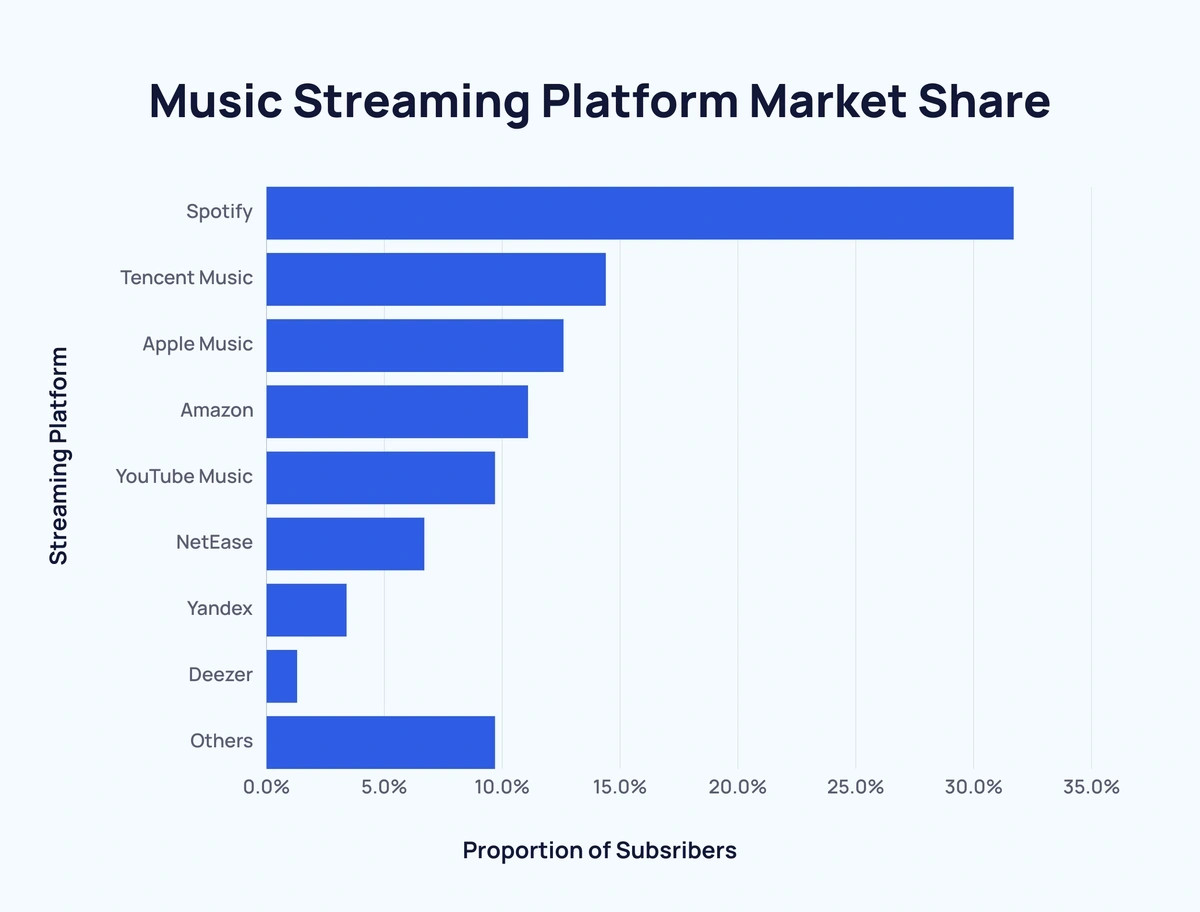

Spotify Leads Music Streaming Market Share (MIDiA)

Spotify is the current market leader in music streaming, holding a 31.7% market share.

Bar chart showing the market share of various music streaming platforms

Bar chart showing the market share of various music streaming platforms

Alt text: Bar graph showing music streaming platform market share, with Spotify leading at 31.7%, followed by Tencent Music at 14.4%, and Apple Music at 12.6%, based on MIDiA data.

Market share breakdown by platform:

| Streaming Platform | Proportion of Subscribers |

|---|---|

| Spotify | 31.7% |

| Tencent Music | 14.4% |

| Apple Music | 12.6% |

| Amazon | 11.1% |

| YouTube Music | 9.7% |

| NetEase | 6.7% |

| Yandex | 3.4% |

| Deezer | 1.3% |

| Others | 9.7% |

Standard Monthly Subscription Price for Music Streaming (Forbes)

The typical monthly cost for a music streaming subscription is around $10.

Monthly costs for top streaming services:

| Streaming Service | Monthly Cost (USD) |

|---|---|

| Spotify Premium | $10.99 |

| Apple Music | $10.99 |

| Tidal | $10.99 |

| Amazon Music Unlimited | $9.99 |

| YouTube Music | $10.99 |

Spotify’s Extensive Premium Subscriber Base (Backlinko, Spotify)

Spotify Premium boasts a substantial subscriber base, exceeding 200 million. As of Q4 2023, Spotify had approximately 236 million premium subscribers, reflecting its strong market position and user appeal.

Graphic stating the number of Spotify Premium subscribers worldwide

Graphic stating the number of Spotify Premium subscribers worldwide

Alt text: Infographic stating Spotify Premium subscriber count at 236 million as of Q4 2023, according to Spotify data.

Growth of Spotify Premium subscribers over time:

| Quarter | Spotify Premium Subscribers (Millions) |

|---|---|

| Q1 2015 | 18 |

| Q2 2015 | 22 |

| Q3 2015 | 24 |

| Q4 2015 | 28 |

| Q1 2016 | 30 |

| Q2 2016 | 36 |

| Q3 2016 | 40 |

| Q4 2016 | 48 |

| Q1 2017 | 52 |

| Q2 2017 | 59 |

| Q3 2017 | 62 |

| Q4 2017 | 71 |

| Q1 2018 | 75 |

| Q2 2018 | 83 |

| Q3 2018 | 87 |

| Q4 2018 | 96 |

| Q1 2019 | 100 |

| Q2 2019 | 108 |

| Q3 2019 | 113 |

| Q4 2019 | 124 |

| Q1 2020 | 130 |

| Q2 2020 | 138 |

| Q3 2020 | 144 |

| Q4 2020 | 155 |

| Q1 2021 | 158 |

| Q2 2021 | 165 |

| Q3 2021 | 172 |

| Q4 2021 | 180 |

| Q1 2022 | 182 |

| Q2 2022 | 188 |

| Q3 2022 | 195 |

| Q4 2022 | 205 |

| Q1 2023 | 210 |

| Q2 2023 | 220 |

| Q3 2023 | 226 |

| Q4 2023 | 236 |

Spotify Outpaces Apple Music in Subscriber Numbers (Business of Apps, Edison Trends)

Spotify maintains a significant lead over competitors like Apple Music in terms of subscriber numbers, holding more than double the subscribers of Apple Music.

Subscriber Comparison Across Major Platforms:

| Year | Spotify (Millions) | Tencent Music (Millions) | YouTube Music (Millions) | Apple Music (Millions) | Amazon Music (Millions) | NetEase Music (Millions) |

|---|---|---|---|---|---|---|

| 2016 | 36 | – | 3 | 20 | – | – |

| 2017 | 59 | – | 2.8 | 27 | – | – |

| 2018 | 83 | 23.3 | 10 | 40 | 16 | – |

| 2019 | 108 | 31 | 18 | 50 | 32 | 6.7 |

| 2020 | 138 | 47.1 | 30 | 72 | 55 | 16 |

| 2021 | 165 | 60.9 | 50 | 80 | 63 | 26.1 |

| 2022 | 188 | 82.7 | 80 | 88 | 74 | 37.6 |

| 2023 | 220 | 106.7 | 100 | 93 | 80 | 44.1 |

Top Streamed Music and Genre Trends

Most Streamed Song of 2023 and Album Trends (Nielsen)

Miley Cyrus’s “Flowers” was the most streamed song of 2023, amassing approximately 1.6 billion streams. This surpasses the previous year’s top song by a significant margin. For the second consecutive year, Bad Bunny’s “Un Verano Sin Ti” was the most streamed album, with 4.5 billion streams.

Top streamed songs over recent years:

| Year | Song | Artist | Streams (Millions) |

|---|---|---|---|

| 2018 | God’s Plan | Drake | 917.9 |

| 2019 | Old Town Road | Lil Nas X | 1000 |

| 2020 | The Box | Roddy Ricch | 920.4 |

| 2021 | Levitating | Dua Lipa | 626.6 |

| 2022 | As It Was | Harry Styles | 1500 |

| 2023 | Flowers | Miley Cyrus | 1600 |

Drake: Artist of the Decade for Streaming (chart data)

Drake emerged as the most-streamed artist of the 2010s, accumulating over 36 billion streams. The decade saw numerous artists achieve massive streaming numbers.

Top Streamed Artists of the 2010s:

| Rank | Artist | Streams (Billions) |

|---|---|---|

| 1 | Drake | 36.3 |

| 2 | Post Malone | 18.9 |

| 3 | Eminem | 17.8 |

| 4 | Ariana Grande | 13.9 |

| 5 | Future | 13.9 |

| 6 | The Weeknd | 13.6 |

| 7 | Taylor Swift | 13.3 |

| 8 | XXXTentacion | 13 |

| 9 | Ed Sheeran | 12.9 |

| 10 | Rihanna | 12.8 |

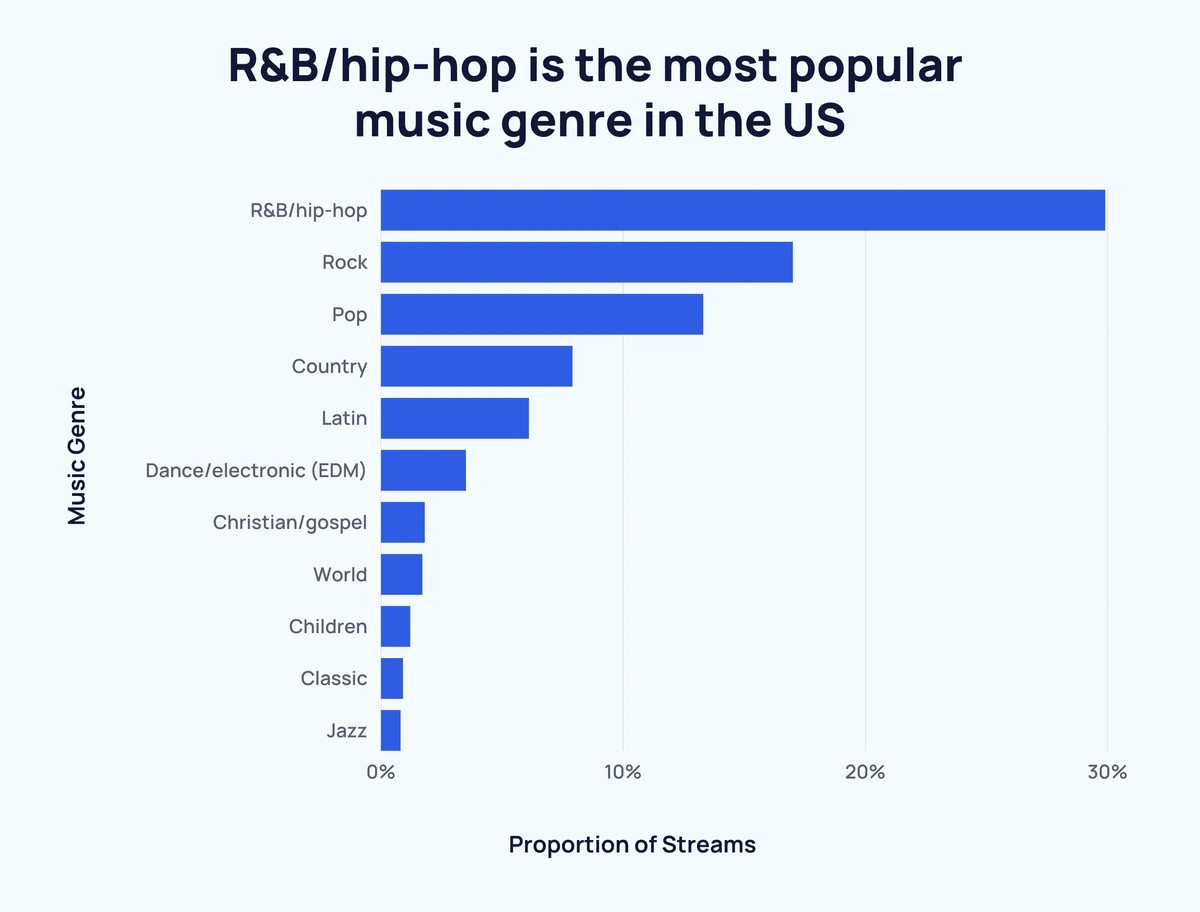

R&B/Hip-Hop: Most Popular Genre in the US Streaming Market (Nielsen)

R&B/hip-hop is the dominant music genre on streaming platforms in the US, accounting for nearly one-third (29.9%) of all streamed songs. This is almost double the share of the second most popular genre, rock (17%).

Bar chart showing the popularity of music genres on streaming services in the US

Bar chart showing the popularity of music genres on streaming services in the US

Alt text: Bar graph illustrating music genre popularity on US streaming platforms, with R&B/Hip-Hop leading at 29.9%, followed by Rock at 17% and Pop at 13.3%, based on Nielsen data.

Genre popularity breakdown in the US streaming market:

| Music Genre | Proportion of Streams |

|---|---|

| R&B/hip-hop | 29.9% |

| Rock | 17% |

| Pop | 13.3% |

| Country | 7.9% |

| Latin | 6.1% |

| Dance/electronic (EDM) | 3.5% |

| Christian/gospel | 1.8% |

| World | 1.7% |

| Children | 1.2% |

| Classic | 0.9% |

| Jazz | 0.8% |

Conclusion

Music streaming’s growth trajectory and market dominance are unmistakable. The data clearly indicates that streaming is not just a significant part of the music industry—it is the industry. As streaming services continue to evolve and innovate, they will undoubtedly remain central to how music is created, distributed, and enjoyed worldwide.

For further insights into related trends, explore Huge Streaming Trends and Video Streaming Services Stats.