Dealing with errors on your credit report or a low credit score can be frustrating, and the idea of hiring a credit report repair service to handle it for you can be very appealing. After all, these companies promise to fix your credit and remove negative items, often for a hefty fee. But before you decide to pay for these services, it’s crucial to understand what they can and cannot do, and whether you could achieve the same results yourself for free. This article breaks down the reality of Credit Report Repair Services, empowering you to make informed decisions about your credit health.

Understanding Credit Report Repair Services and the Law

Credit report repair services primarily focus on disputing negative information on your credit reports with the three major credit bureaus: Experian, Equifax, and TransUnion. While this sounds helpful, it’s important to know that these companies aren’t miracle workers. In fact, federal law has been put in place to protect consumers from deceptive practices within this industry.

The Credit Repair Organizations Act (CROA), enacted in 1997, was a direct response to widespread credit repair scams. This law ensures that legitimate credit report repair service companies operate with transparency and accountability. CROA includes several key provisions designed to safeguard consumers:

- No Upfront Fees: Credit repair companies are legally prohibited from charging you any fees until they have fully completed the services they promised in your contract.

- Mandatory Written Contract: They must provide you with a detailed written contract outlining all the services they will provide, along with the complete terms and conditions of payment. You also have a legal right to cancel the contract within three days of signing it.

- No Misleading Practices: Credit repair services are forbidden from advising you to make false statements to credit reporting agencies about your credit accounts or to alter your identity in any way to manipulate your credit history.

- Truthful Claims: They cannot make false or misleading claims about the services they can perform or the results they can achieve.

- Protection of Your Rights: Companies cannot ask you to sign away your rights under CROA, and any attempt to do so is legally unenforceable.

credit repair contract

credit repair contract

While CROA provides essential protections, it doesn’t eliminate all risks. Despite these regulations, government bodies like the Consumer Financial Protection Bureau (CFPB) continue to take action against credit repair companies that violate the law, often for practices such as charging illegal upfront fees and making misleading promises to consumers about their ability to “fix” credit.

The Cost and Reality of Paying for Credit Repair

If you identify inaccuracies on your credit reports, credit report repair services will likely offer to dispute these items on your behalf. Their pricing structures typically involve either a monthly subscription fee or a per-item deletion fee. Monthly fees can average around $75 per month, but this can vary. Similarly, per-deletion fees can range upwards of $50 or more for each item they successfully remove.

However, it’s vital to understand that disputing information on your credit report is a right you have and can exercise yourself, completely free of charge. Credit bureaus like Experian provide clear processes for disputing inaccuracies without requiring any payment or special forms.

Furthermore, it’s critical to be realistic about what credit report repair services can actually accomplish. While they can dispute negative items, they cannot legally remove accurate negative information. Attempts to remove legitimately reported information can sometimes border on unethical or even illegal activities. While some companies may aggressively dispute every negative item, accurately reported information from your lenders is unlikely to be removed.

Crucially, remember this: credit report repair services cannot do anything for you that you cannot legally do yourself for free. Before you spend money on these services, it’s always wise to explore repairing your credit yourself first.

DIY Credit Repair: Steps You Can Take

While there’s no magic wand to instantly erase credit problems, there are concrete steps you can take to improve your credit profile and scores over time. Accurate negative information, such as missed payments or collection accounts, will remain on your credit report for a period of seven to ten years. However, by proactively managing your credit, you can build a more positive credit history.

Check Your Credit Report

The first step in taking control of your credit is to thoroughly review your credit reports. Understanding what information lenders see is essential for effective credit repair. You are entitled to free credit reports from each of the major credit bureaus annually through AnnualCreditReport.com. Take advantage of this right and examine your reports from Experian, Equifax, and TransUnion.

Reviewing your Experian credit report, for example, will give you a detailed overview of your credit history. You can also obtain your free credit score from Experian to understand your current credit standing. Along with your score, Experian provides a list of key factors impacting your score, giving you specific areas to focus on for improvement.

If you find information on your credit report that you believe is inaccurate, you have the right to file a dispute with the credit bureau reporting the error. Experian provides a straightforward online dispute process. It’s also advisable to contact the creditor who reported the incorrect information directly and request them to correct their records as well.

Improve Your Payment History

Your payment history is the single most influential factor in most credit scoring models, including FICO®. Late payments, missed payments, bankruptcies, and collections all negatively impact your credit scores. These negative marks can remain on your report for years, affecting your creditworthiness.

The severity of the impact often depends on the size of the debt and the recency of the missed payments. Larger debts and more recent late payments typically have a more significant negative effect. However, bringing past-due accounts current and consistently making timely payments going forward will almost always have a positive impact on your credit scores over time.

Manage Your Credit Utilization Ratio

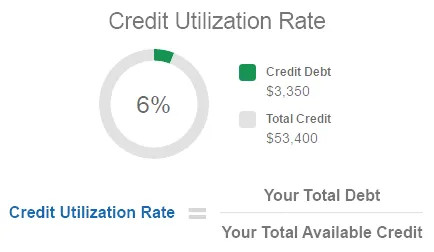

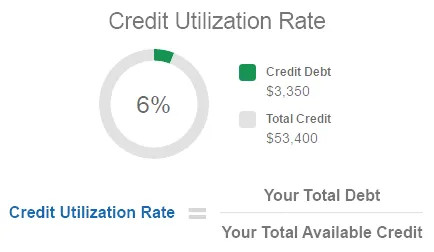

Credit utilization, or your credit utilization ratio, is another key factor in credit scoring. This ratio represents the amount of credit you’re using compared to your total available credit. It’s calculated by dividing your total revolving debt (like credit card balances) by your total credit limit and expressing it as a percentage.

For example, if you have $3,000 in credit card balances and a total credit limit of $10,000 across all your cards, your credit utilization ratio is 30%.

High credit utilization can negatively affect your credit scores. Generally, it’s recommended to keep your credit utilization below 30%. A lower ratio is generally better for your credit score.

There are several strategies to reduce your credit utilization:

- Pay Down Balances: The most direct way is to aggressively pay down your credit card balances.

- Increase Credit Limits: Requesting a credit limit increase on your existing cards or opening a new credit card can increase your total available credit, lowering your utilization ratio. However, be cautious as this could lead to increased spending.

- Debt Consolidation: Consolidating credit card debt with a personal loan can shift the debt from revolving credit to installment debt, which isn’t factored into credit utilization.

credit repair contract

credit repair contract

While increasing your credit limit may seem like a quick fix, it’s important to be responsible. If a higher limit tempts you to overspend, it could worsen your debt situation. Opening new credit cards also results in a hard inquiry on your credit report, which can temporarily slightly lower your score. Debt consolidation loans may be harder to obtain with a poor credit score and may come with high interest rates. Therefore, consistently paying down your balances is often the most effective and sustainable way to improve your credit utilization and scores.

Account Diversity and Credit History Length

Credit scoring models also consider the types of credit accounts you have and the age of your credit history. Having a mix of credit types, such as credit cards and installment loans, can be viewed positively. Additionally, a longer credit history, particularly the age of your oldest account and the average age of all accounts, can boost your credit scores.

When you’ve paid off a credit card, even if you don’t plan to use it regularly, consider keeping the account open. Closing accounts can reduce your available credit, potentially increasing your credit utilization ratio and negatively impacting your credit history age. Keeping paid-off, older accounts in good standing can be beneficial for your credit profile. Debt consolidation can also be a strategic tool for managing different types of debt.

Be Mindful of New Credit

Opening numerous credit accounts in a short period can signal higher risk to lenders and may negatively impact your credit scores. Before applying for new loans or credit cards, consider the potential effect on your credit.

However, when shopping for major loans like auto loans or mortgages, multiple credit inquiries within a short timeframe (usually 14-45 days, depending on the scoring model) are often treated as a single inquiry. This is known as rate shopping, and it allows you to compare offers without significantly harming your credit score. Remember that hard inquiries generally have a greater impact when they are recent and remain on your credit report for 24 months.

Timeline for Credit Rebuilding

There’s no precise answer to how long it takes to rebuild credit, as it’s unique to each individual’s credit history. The time to see improvement depends on the nature and severity of past credit issues and how long ago they occurred. Some actions, like paying down credit card balances, can show results relatively quickly. Others may take months to have a noticeable positive effect.

When disputing inaccurate information, the credit bureau has up to 30 days to investigate. If the dispute is found to be valid, the incorrect information will be removed, and your score will be recalculated, reflecting the change.

When you make payments or reduce balances, allow time for these updates to be reflected on your credit report. Creditors typically report to credit bureaus periodically, often monthly. It can take up to 30 days or longer for your account statuses to be updated, depending on the creditor’s reporting cycle.

Regularly monitoring your credit score is crucial to track your progress and ensure accurate reporting. As you consistently build a positive credit history, your credit scores are likely to improve, enhancing your access to favorable credit terms when you need them in the future.

Seeking Extra Help: Credit Counseling and Debt Management

If you’re managing manageable debt, debt consolidation through a personal loan or balance transfer credit card might be a beneficial strategy. Personal loans can sometimes offer lower interest rates and more manageable monthly payments, provided you qualify and adhere to the terms. Balance transfer cards often come with introductory 0% APR periods, allowing you to pay down balances interest-free during the promotional period. Be sure to avoid accumulating new debt on the original cards once you transfer balances.

For those facing overwhelming debt and struggling to qualify for balance transfer cards or low-interest loans, seeking help from a reputable credit counseling agency can be invaluable. Many non-profit agencies offer free consultations and personalized advice. The National Foundation for Credit Counseling (NFCC) is a valuable resource for finding reputable credit counselors.

Credit counselors can assist in developing a debt management plan (DMP) for unsecured debts like credit cards. With a DMP, you make monthly payments to the counseling agency, which then distributes the funds to your creditors. Agencies may also negotiate with creditors for lower interest rates and monthly payments.

Be aware that if a credit counselor negotiates settlements where you pay less than the original amount owed, it could negatively impact your credit score in the short term. Your credit report may also indicate that accounts are being paid through a DMP, which some lenders may view negatively. However, if you consistently make payments on time under the DMP, the overall long-term impact on your credit can still be positive.

Maintaining Good Credit Long-Term

Once you’ve successfully rebuilt your credit history, it’s tempting to relax. While you may not need to focus on it as intensely as before, maintaining good credit is an ongoing process.

Regular credit monitoring is essential. It helps you detect any potential issues that could cause your score to decline and alerts you to potential identity theft, allowing you to address problems quickly.

Experian offers a free credit monitoring tool that provides access to your FICO® Score powered by Experian data and your Experian credit report. You’ll also receive real-time alerts about new inquiries, new accounts, suspicious activity, and changes to your personal information. Staying vigilant and informed is key to maintaining healthy credit for the long term.

By understanding your credit, taking proactive steps for self-repair, and utilizing available resources responsibly, you can effectively manage and improve your credit health without necessarily resorting to paid credit report repair services. Remember, you have the power to take control of your credit future.