For years, many individuals have reported receiving unsolicited phone calls from someone claiming to be “Heather from account services,” offering enticing deals like reduced interest rates on credit cards. Cole Zelznak, for example, was a frequent recipient, despite not even owning a credit card [*].

The truth is, “Heather,” “Jonathan,” or any of the countless generic names used in these calls are not real people. They are part of a widespread and highly profitable phone scam: the Account Services Call scam.

These deceptive phone calls are rampant across the United States, and the problem is escalating.

Recent statistics indicate that Americans were bombarded with a staggering 50.3 billion spam calls in the past year alone [*].

While some scam calls are easily identifiable before you even answer, the seemingly legitimate nature of a call from “account services” can make you more likely to pick up. But how can you distinguish between a genuine account services call and a fraudulent one?

This guide will delve into the mechanics of account services call scams, highlight crucial warning signs, and provide actionable steps to take if you are persistently targeted by these scam calls, or if you’ve mistakenly shared sensitive information over the phone.

Understanding Account Services Calls and Scam Identification

Account services call scams are a form of phone fraud where scammers manipulate caller ID systems to display names like “account services” or “cardmember services.” Upon answering, these fraudsters impersonate representatives from various financial institutions, such as credit card companies, debt collection agencies, banks, or even utility providers.

iPhone settings screen showing the option to block a specific phone number

iPhone settings screen showing the option to block a specific phone number

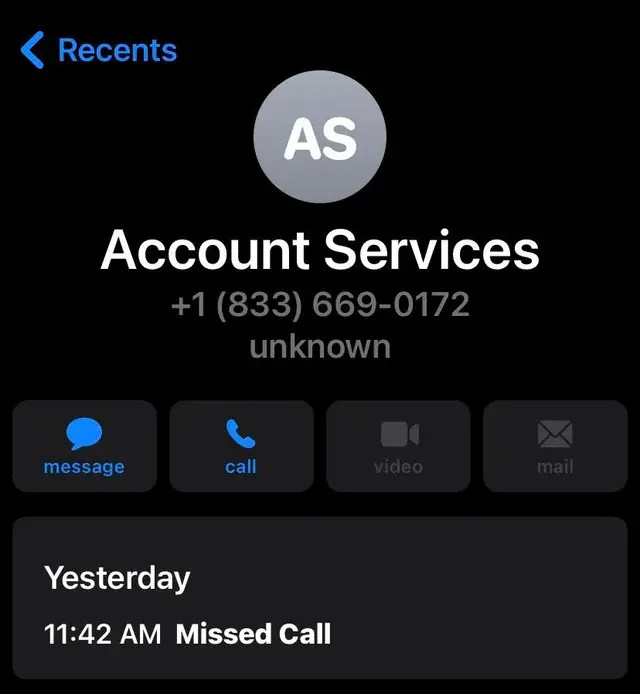

Example of a spoofed caller ID displaying “Account Services”. Source: Reddit.

These deceptive “representatives” might offer enticing, but fake, debt reduction programs or attractive credit card deals to trick you into divulging your personal financial details. Alternatively, they might employ threatening tactics, claiming you have an overdue payment on a non-existent loan and demanding immediate payment, or they might request you to “verify” your account details by providing sensitive information under false pretenses.

Any personal information you reveal can be exploited to empty your bank accounts, commit identity theft, or target you with further phishing attempts [phishing scams].

The particularly insidious nature of account services call scams lies in the fact that many legitimate companies do have genuine “account services” departments. Therefore, distinguishing between a real and fraudulent call is crucial.

Here are key indicators to help you identify a phone scammer during a call:

- Unsolicited Robocalls: Receiving an unsolicited robocall is a major red flag. While robocalls themselves aren’t inherently illegal, legitimate companies are legally restricted from using them to contact you unless you have explicitly granted them permission. A robocall from an unrecognized entity is highly likely to be a scam.

- Requests for “Verification” of Sensitive Information: Legitimate customer service representatives will never ask for your complete credit card number, Social Security number (SSN), or account passwords. Protect yourself by never disclosing this type of information over the phone to an unsolicited caller.

- Threats of Penalties or Legal Actions: Genuine service providers typically send multiple email reminders and postal letters regarding overdue invoices before resorting to phone calls from debt collectors. Authentic debt collectors will not pressure you for immediate payment or threaten wage garnishment without a court order. If you have concerns about a missed payment, proactively contact the company directly through their official support channels.

- Lack of Personalization and Account Knowledge: Legitimate representatives should address you by name and possess readily available key account details and contact information. They should be prepared to answer your questions about your account and company policies transparently. Scammers often lack this personalized information.

- Claims of Unrecognized Debts: Unless you are a victim of identity theft, you cannot owe money for services or products you did not acquire. If a caller claims you owe for an unfamiliar account, immediately check your bank statements and credit reports for potential signs of identity theft.

- Noticeable Pause After Answering: A brief silence after you answer before anyone speaks is often indicative of robocalling software connecting scammers to potential victims. This pause is a technical artifact of the automated dialing system.

- Offers Too Good To Be True: Be wary of overly generous offers. If a caller presents a deal that seems unrealistically good, and then asks for personal information to “claim” the offer or prize, it is a scam. They may request your bank details to “deposit winnings,” which is a tactic to steal your account information.

- Defensiveness When Challenged: Legitimate companies, including telemarketers, are concerned about spam complaints and will typically remove you from their lists if you express concern. Scammers, however, are indifferent to reputation and customer reviews. If a caller becomes defensive or insistent when you question the legitimacy of the call, it’s a strong indication of a scam.

🛡 Enhance your defense against fraud. Identity Guard offers award-winning identity theft protection, proactively monitoring your sensitive information and accounts, and providing near real-time alerts to potential fraud. Save 33% on Identity Guard today.

Distinguishing “Account Services Collections” from Scammers

Adding to the confusion, a legitimate debt collection agency named “Account Services Collections” operates out of San Antonio, Texas. This agency might contact individuals regarding outstanding debts.

If you receive a call from someone claiming to be from “Account Services Collections,” it is essential to ensure they adhere to the regulations governing all legitimate debt collectors.

The Fair Debt Collection Practices Act (FDCPA) outlines prohibited actions for debt collectors [*], including:

- Employing unfair, deceptive, or abusive tactics during contact.

- Contacting you before 8:00 a.m. or after 9:00 p.m.

- Contacting you at your workplace if you’ve informed them that such calls are not permitted.

- Continuing contact after you’ve requested them to cease communication or informed them of legal representation.

- Approaching you at inconvenient or unusual locations.

Furthermore, debt collectors are legally obliged to disclose the original creditor’s identity and address, the debt amount, and explicitly inform you of your right to dispute the debt. If you suspect a debt collector is violating these regulations, you can file a complaint with the Federal Trade Commission (FTC), the Consumer Financial Protection Bureau (CFPB), or your state’s Attorney General’s Office.

Proactive Steps to Combat Persistent Account Services Scam Calls

If you are concerned that an incoming call might be from a scammer, take a moment to pause and assess the situation. Scammers thrive on creating a sense of urgency to pressure you into acting impulsively without critical thought.

Resist falling victim to their schemes. Instead, adopt these strategies to prevent account services scam calls from dominating your phone interactions:

1. Rigorously Verify Caller Identity and Information

Phone scammers frequently impersonate authoritative entities like credit card companies, debt collectors, and government agencies such as the Internal Revenue Service (IRS). Whenever you receive unsolicited calls from individuals claiming to represent a company or agency, prioritize verifying their identity and the information they provide before engaging further.

Methods to verify the legitimacy of an account services call:

- Request Identifying Details and Independently Verify: Ask for the caller’s full name, extension number (if applicable), or a reference number. Then, politely end the call. Independently contact the purported organization using their official phone number found on their website or official documentation. For unfamiliar companies, utilize resources like the Better Business Bureau’s (BBB) Scam Tracker site or conduct a web search using “[company name] + scam/review/legitimate?” to check for reported scams or reviews.

- Direct Account Review: Scammers often create convincing but fake websites that mimic legitimate login pages of banks or other subscription services. Access your accounts directly through official mobile apps or by typing the official website address into your browser to review account details and verify any claims made by the caller.

- Debt Validation and Statute of Limitations: If the call pertains to a debt, legitimate collectors should readily provide details about the creditor and the debt amount. Review your financial records to confirm transaction dates and cross-reference them with your state’s statute of limitations on debt collection. For example, California has a four-year statute of limitations for debt collection lawsuits [*].

💡 Related Resource: How To Prevent Identity Theft →

2. Block Spam Numbers Directly on Your Phone

Once scammers obtain your phone number, they will likely continue to target you, hoping you will eventually answer.

Both iPhones and Android devices offer built-in features to block specific phone numbers. While this won’t prevent scammers from using different numbers, blocking can significantly reduce repeat calls from the same fraudulent number.

Steps to block numbers on an iPhone [*]:

- Open the Phone app. Navigate to the number you wish to block through Contacts, Favorites, Recents, or Voicemail.

- Tap the Information icon (i) next to the number or contact name.

- Scroll down and select Block this Caller.

Steps to block numbers on an Android phone [*]:

- Open the Phone app.

- Long-press the number you want to block.

- Tap Block.

Alternatively, inquire with your mobile service provider about their spam call blocking services.

Major providers like AT&T, Verizon, and T-Mobile often automatically identify potential spam calls as “scam likely,” and some offer enhanced protection features for a nominal monthly fee [*].

Regarding the Do Not Call registry: It’s important to note that this registry primarily targets legitimate telemarketing calls and is ineffective against illegal scam operations.

3. Activate “Silence Unknown Callers” Feature

While blocking individual numbers is a useful tactic, scammers frequently operate with numerous numbers, sometimes even spoofing numbers with your local area code [*].

Most modern smartphones offer a feature to automatically silence incoming calls from numbers not in your contacts.

To activate this feature:

- On iPhone: Go to Settings, then Phone, and toggle on Silence Unknown Callers. This feature is available for iOS 13 and later versions.

- On Android: Open the Phone app, tap the three-dot menu, select Settings, go to Caller ID & Spam, and enable Spam protection. You may also see an option like “Automatically screen. Decline robocalls.”

Pixel phones and some other Android devices offer manual call screening via Google Assistant [*]. When a call arrives, tap “Screen call.” Google Assistant will answer on your behalf, asking the caller to identify themselves and the purpose of the call. You will receive a real-time transcript of the caller’s response and can choose from pre-set replies like “Report as spam” or “Is it urgent?” You can then decide to answer or hang up.

💡 Related Resource: What To Do If Scammers Have Your Phone Number →

4. Report Impersonation Scams to Targeted Companies

Contact the customer support department of the company being impersonated and report the scam incident. Provide detailed information about how the scammer contacted you, what they said, and any information you might have disclosed. The more details you provide, the greater the chance of disrupting the illegal activity and recovering any potential financial losses.

If you inadvertently shared banking information, immediately cancel your cards and close affected accounts. Additionally, report the scam to relevant government authorities. Use USA.gov’s “Where to report a scam” quiz to identify the appropriate agency for your specific situation.

You’ll be asked to categorize the scam type (e.g., banking, imposter, identity theft) and provide other relevant information to direct your report effectively. Reporting to the Better Business Bureau (BBB) can also help alert others to similar scams.

💡 Related Resource: What To Do If You’ve Been Scammed Over the Phone →

5. Consider Third-Party Spam Call Protection Apps

While built-in phone features and carrier-provided spam protection offer a degree of defense, sophisticated scammers often find ways to bypass these measures.

Modern AI-powered Call Assistants provide more advanced protection by analyzing calls and text messages for known scam patterns and language. They can automatically block suspicious callers or filter out dangerous text messages. Legitimate and important calls, such as those from doctors, for urgent matters, or deliveries, are correctly routed, while potentially harmful voicemails and texts are moved to junk folders.

6. Remove Your Phone Number from Data Broker Lists

Data brokers collect vast amounts of personal information on individuals and sell this data to businesses and organizations for marketing purposes. The limited regulation of data purchasing makes it a valuable resource for fraudsters.

Scammers can readily purchase data broker lists to obtain your phone number and other personal details [*].

To opt out of data broker lists, you need to visit each data broker’s website and follow their specific opt-out procedures. Prominent data brokers include Acxiom, USPhoneBook, People Finder, Spokeo, and Whitepages.

Alternatively, Identity Guard offers an automated service to scan data broker databases and request the removal of your information on your behalf [*].

💪 Strengthen your defenses against spam and scams. Identity Guard combines award-winning identity theft protection with automated data broker removal to offer robust scam protection. Save 33% on Identity Guard today.

Actions to Take If You Disclosed Sensitive Information to Phone Scammers

Simply answering a spam call generally poses minimal immediate risk. However, revealing any personal information, even seemingly innocuous details like your name, address, account details, or even just saying “yes”, can expose you to identity theft, fraud, and hacking.

If you have inadvertently shared personal information with a scammer, take these immediate steps to secure your accounts and mitigate potential damage:

- Contact Law Enforcement and Regulatory Bodies: If you suspect identity theft, file an official report with the Federal Trade Commission (FTC) at IdentityTheft.gov. Consider also filing a complaint with the Federal Communications Commission (FCC). Use your case numbers when restoring your credit and disputing unauthorized charges.

- Freeze Your Credit with All Three Major Bureaus: A credit freeze prevents scammers from using your stolen information to open new accounts or obtain loans in your name. Contact each of the three major credit bureaus – Experian, Equifax, and TransUnion – individually to initiate a credit freeze. Remember, you are entitled to a free credit report from each bureau annually, and until the end of 2023, you can access weekly reports [*].

- Inform the Fraud Department of Impacted Companies: Contact the fraud department of any companies whose accounts may be compromised. They might be aware of the ongoing scam and have established procedures to secure your accounts and help recover any losses.

- Update Passwords and Enable Two-Factor Authentication (2FA): Change passwords for all your online accounts to strong, unique passwords. Enhance security further by enabling two-factor authentication (2FA) wherever possible, using authenticator apps like Authy or Duo. 2FA adds an extra layer of security by requiring a one-time code or biometric verification to access your accounts.

- Consider Identity Monitoring and Protection Services: Signing up for an identity monitoring and protection service offers proactive protection with near-instant fraud alerts. These services often include identity restoration assistance and insurance coverage for financial losses resulting from identity theft.

- Report the Scam Number to Your Mobile Carrier: Scammers can exploit your phone number to reroute text messages, steal data, install malware, and even engage in doxing (publicly revealing your personal information). Contact your carrier’s customer support to set up a PIN code to prevent unauthorized changes to your number and initiate a SIM lock to prevent SIM swapping attempts.

- Alert Your Network of Contacts: Inform friends and family about the scam. Scammers may use the information they obtained to create fake social media profiles in your name and solicit money from your contacts.

💡 Related Resource: How To Check If Someone Opened an Account In Your Name →

Final Thoughts: Exercise Caution with Unfamiliar Calls

Phone scams are a pervasive threat in the US, with fraudsters frequently impersonating representatives from trusted companies.

The most effective strategy for staying safe is to avoid answering calls from unknown numbers and let them go to voicemail. However, in the fast pace of daily life, it’s easy to forget precautions and inadvertently answer a fraudulent call. Protect yourself from scammers and gain peace of mind with Identity Guard.

For over 25 years, Identity Guard has been committed to protecting consumers from fraud and scams, safeguarding 38 million individuals. Their award-winning identity theft protection includes comprehensive three-bureau credit monitoring, bank alerts, and personal information exposure notifications. In the event of identity compromise, Identity Guard plans provide dedicated U.S.-based White Glove Fraud Resolution support and a $1 million insurance policy to help you recover.