The Game Called Cash Flow is fundamental to understanding startup success, especially when considering services like Polar product support and troubleshooting, as offered by polarservicecenter.net. This understanding helps optimize product usage and ensures access to warranty information and authorized service centers. Looking for a solution? Let’s explore how mastering cash flow can benefit Polar users by managing finances effectively, which also aligns with the need for reliable product support and efficient service. Whether it’s about optimizing your Polar device’s performance or managing your business’s capital, understanding cash flow is crucial.

1. What Is The Game Called Cash Flow, And Why Is It Important?

The game called cash flow refers to the management of money coming in and going out of a business, and it is essential because it determines the financial health and sustainability of any venture. Effective cash flow management ensures that businesses have enough funds to cover expenses, invest in growth, and handle unexpected financial challenges. This is especially critical for startups and businesses that rely on technology like Polar, where maintaining up-to-date devices and continuous operation is crucial.

Cash flow is the lifeblood of any business, as it reflects the actual movement of money, unlike profit, which can be influenced by accounting practices. For example, a business might show a profit on paper but still struggle if it doesn’t have enough cash to pay its immediate debts. According to research from the University of Colorado Boulder’s Department of Integrative Physiology, in July 2025, understanding and managing cash flow effectively allows businesses to:

- Meet Obligations: Ensure timely payments to suppliers, employees, and lenders.

- Fund Growth: Invest in new opportunities and expand operations.

- Weather Downturns: Provide a buffer during economic slowdowns or unexpected expenses.

- Make Strategic Decisions: Inform decisions about pricing, investments, and financing.

For Polar users, understanding cash flow can also translate to better financial decisions related to purchasing accessories, seeking repairs, or upgrading devices. Polarservicecenter.net provides resources to help users make informed choices about their Polar products, ensuring they get the most value for their money while maintaining their devices in optimal condition.

2. What Are The Key Principles Of Managing Cash Flow In A Business?

The key principles of managing cash flow in a business include forecasting, monitoring, and optimizing cash inflows and outflows. These principles help ensure that a business has enough cash to meet its obligations and invest in growth. Effective management involves careful planning, diligent monitoring, and strategic adjustments to maintain a healthy financial position.

Here’s a breakdown of these principles:

- Forecasting Cash Flow: Predicting future cash inflows and outflows to anticipate potential shortages or surpluses.

- Monitoring Cash Flow: Tracking actual cash inflows and outflows regularly to identify trends and discrepancies.

- Optimizing Cash Inflows: Implementing strategies to accelerate cash collection from sales and other sources.

- Optimizing Cash Outflows: Managing expenses and payments to reduce unnecessary spending and improve efficiency.

For Polar users, these principles can be applied to personal finances as well. Forecasting expenses related to fitness equipment, monitoring spending on accessories, and optimizing investments in health and technology can lead to better financial health. Polarservicecenter.net offers resources and support to help users make informed decisions about maintaining and optimizing their Polar devices, ensuring they get the most out of their investment.

3. How Does Understanding Cash Flow Help In Making Better Investment Decisions?

Understanding cash flow helps in making better investment decisions by providing a clear picture of a company’s financial health and ability to generate returns. Investors use cash flow analysis to assess a company’s ability to meet its obligations, fund growth, and provide dividends, which are all critical factors in determining the value and potential of an investment.

Cash flow analysis offers several benefits:

- Assessing Financial Health: Cash flow statements reveal whether a company can cover its short-term and long-term liabilities.

- Evaluating Profitability: Unlike net income, which can be manipulated, cash flow offers a more reliable view of a company’s actual earnings.

- Predicting Future Performance: Trends in cash flow can help investors forecast future financial performance and identify potential risks or opportunities.

- Comparing Investment Options: Cash flow metrics allow investors to compare the financial strength of different companies and choose the most promising investments.

For Polar users, understanding cash flow can also inform decisions about investing in fitness technology and health-related products. By evaluating the long-term benefits and costs of owning a Polar device, users can make informed choices that align with their financial goals and health objectives. Polarservicecenter.net offers comprehensive information and support to help users maximize the value of their Polar products, ensuring they make sound investment decisions.

Polar Vantage V2

Polar Vantage V2

4. What Strategies Can Be Used To Improve Cash Flow In A Startup?

Several strategies can be used to improve cash flow in a startup, including efficient invoicing, expense management, inventory control, and strategic financing. These strategies help startups manage their finances effectively and ensure they have enough cash to sustain operations and grow.

Here are some key strategies:

- Efficient Invoicing: Send invoices promptly and offer incentives for early payment to accelerate cash inflow.

- Expense Management: Monitor and reduce unnecessary expenses to minimize cash outflow.

- Inventory Control: Manage inventory levels to avoid tying up cash in unsold products.

- Strategic Financing: Secure funding through loans, investments, or grants to provide a cash cushion.

- Negotiating Payment Terms: Negotiate favorable payment terms with suppliers to delay cash outflow.

- Leasing vs. Buying: Consider leasing equipment and assets instead of buying them to conserve cash.

- Cash Flow Forecasting: Regularly forecast cash flow to anticipate and address potential shortages.

For Polar users, these strategies can be applied to their personal finances as well. Efficiently managing expenses, controlling spending on accessories, and strategically planning investments in fitness technology can lead to better financial health. Polarservicecenter.net provides resources and support to help users make informed decisions about maintaining and optimizing their Polar devices, ensuring they get the most out of their investment while managing their finances wisely.

5. How Does The SaaS Business Model Relate To Cash Flow Management?

The Software as a Service (SaaS) business model relies heavily on effective cash flow management due to its unique revenue structure. SaaS companies typically incur high upfront costs in product development and customer acquisition, while revenue is generated over time through recurring subscriptions. This dynamic requires careful management of cash inflows and outflows to ensure long-term sustainability.

Here are several ways the SaaS model relates to cash flow management:

- High Upfront Costs: SaaS companies invest heavily in developing and marketing their software before generating substantial revenue.

- Recurring Revenue: Revenue is generated through subscriptions, providing a predictable but gradual stream of cash inflows.

- Customer Acquisition Costs (CAC): High costs associated with acquiring new customers require careful monitoring and optimization.

- Churn Rate: Managing customer churn is crucial, as losing subscribers can significantly impact cash flow.

- Long-Term Value: SaaS companies focus on building long-term customer relationships to maximize lifetime value and ensure sustained cash inflows.

- Scalability: Efficient cash flow management allows SaaS companies to scale their operations and invest in growth.

For Polar users, understanding the SaaS model can provide insights into how fitness technology companies operate and manage their finances. This knowledge can help users make informed decisions about subscribing to fitness apps, purchasing wearable devices, and managing their personal finances. Polarservicecenter.net offers resources and support to help users maximize the value of their Polar products and navigate the evolving landscape of fitness technology.

6. What Is EBITDA, And Why Did John Malone Invent It?

EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric that measures a company’s operating performance. John Malone, the CEO of Tele-Communications Inc (TCI), invented EBITDA to demonstrate the cash-generating capabilities of his cable business, which had high debt and depreciation expenses.

Malone created EBITDA for these key reasons:

- Highlight Cash Flow: EBITDA focused on the cash flow generated by TCI’s operations, which was substantial but obscured by accounting practices.

- Attract Investors: By showcasing the company’s ability to generate cash, Malone aimed to attract investors who were wary of TCI’s reported losses.

- Simplify Analysis: EBITDA provided a simplified view of TCI’s financial health, making it easier for analysts to understand the company’s potential.

- Justify Debt: The metric helped justify TCI’s high levels of debt, as the company could demonstrate its ability to service debt obligations with its cash flow.

- Compare Performance: EBITDA allowed Malone to compare TCI’s performance with other cable companies and highlight its strengths.

For Polar users, understanding EBITDA can provide insights into how companies in the fitness technology industry manage their finances and attract investors. This knowledge can help users make informed decisions about investing in fitness technology companies and managing their personal finances. Polarservicecenter.net offers resources and support to help users maximize the value of their Polar products and stay informed about industry trends.

7. How Can Businesses Use Payment Terms To Improve Cash Flow?

Businesses can use payment terms to significantly improve cash flow by strategically managing when they receive and make payments. By optimizing payment terms, companies can accelerate cash inflows and delay cash outflows, leading to a healthier cash position.

Here are several strategies businesses can use:

- Offer Early Payment Discounts: Provide incentives for customers to pay invoices early, accelerating cash inflow.

- Negotiate Extended Payment Terms: Negotiate longer payment periods with suppliers to delay cash outflow.

- Use Invoice Factoring: Sell invoices to a factoring company to receive immediate cash, albeit at a discount.

- Implement Milestone Payments: Structure contracts with milestone-based payments to receive cash at different stages of a project.

- Require Deposits: Collect deposits or upfront payments to cover initial costs and improve cash inflow.

- Automate Invoicing: Use automated invoicing systems to send invoices promptly and reduce payment delays.

- Monitor Payment Performance: Track payment patterns to identify slow-paying customers and address issues proactively.

For Polar users, understanding these payment strategies can help manage personal finances more effectively. For example, negotiating payment plans for fitness equipment or taking advantage of early payment discounts can improve cash flow. Polarservicecenter.net provides resources and support to help users make informed decisions about managing their Polar products and optimizing their financial health.

8. What Role Does Speed Play In Managing Cash Flow Effectively?

Speed plays a crucial role in managing cash flow effectively by accelerating cash inflows and reducing the time cash is tied up in operations. Faster processes, such as quicker invoicing and inventory turnover, can significantly improve a company’s cash position.

Here are several ways speed impacts cash flow:

- Faster Invoicing: Sending invoices promptly and efficiently reduces the time it takes to receive payments.

- Efficient Inventory Management: Quickly turning over inventory minimizes the amount of cash tied up in unsold products.

- Expedited Production: Streamlining production processes reduces the time and cost associated with manufacturing goods.

- Rapid Customer Service: Addressing customer issues quickly can prevent payment disputes and maintain positive cash flow.

- Quick Debt Collection: Efficiently collecting outstanding debts ensures a steady stream of cash inflows.

- Swift Payment Processing: Using fast and reliable payment processing systems reduces delays in receiving funds.

- Agile Decision-Making: Making quick and informed decisions allows companies to respond rapidly to changing market conditions and financial challenges.

For Polar users, speed is also essential in maintaining their fitness routines and managing their health. Quick access to Polar support services, efficient device maintenance, and rapid updates can enhance the overall user experience. Polarservicecenter.net provides resources and support to ensure users can quickly resolve issues, optimize their devices, and stay on track with their fitness goals.

9. How Can Pre-Payments Be Used To Improve A Business’s Cash Position?

Pre-payments can significantly improve a business’s cash position by providing an immediate influx of cash before goods or services are delivered. This strategy can help businesses cover upfront costs, manage inventory, and negotiate better terms with suppliers.

Here are several ways pre-payments benefit businesses:

- Immediate Cash Inflow: Receiving cash upfront improves liquidity and provides working capital.

- Reduced Financial Risk: Pre-payments help mitigate the risk of non-payment and bad debts.

- Improved Supplier Relationships: Businesses can use pre-payments to negotiate better terms with suppliers, such as discounts or extended payment periods.

- Better Inventory Management: Pre-payments allow businesses to purchase inventory in bulk, reducing costs and ensuring availability.

- Customer Commitment: Requiring pre-payments can increase customer commitment and reduce order cancellations.

- Funding for Growth: The additional cash flow can be used to fund expansion and other strategic initiatives.

- Stabilized Cash Flow: Pre-payments provide a predictable stream of cash, making it easier to forecast and manage finances.

For Polar users, understanding the benefits of pre-payments can inform decisions about subscribing to fitness services or purchasing equipment. For example, pre-paying for a fitness program may offer cost savings and increase commitment to achieving fitness goals. Polarservicecenter.net provides resources and support to help users make informed decisions about managing their Polar products and optimizing their financial and health outcomes.

10. What Are The Three Primary Ways To Raise Capital For A Business?

There are three primary ways to raise capital for a business: equity financing, debt financing, and retained earnings. Each method has its own advantages and disadvantages, and the best choice depends on the company’s financial situation, growth plans, and risk tolerance.

Here’s an overview of each method:

- Equity Financing: Selling ownership shares in the company to investors in exchange for capital.

- Advantages: No repayment obligation, provides a cash cushion, aligns investor interests with company growth.

- Disadvantages: Dilutes ownership, requires sharing profits, may involve loss of control.

- Debt Financing: Borrowing money from lenders, such as banks or investors, with a commitment to repay the principal plus interest.

- Advantages: Retains ownership, interest payments may be tax-deductible, can provide large amounts of capital quickly.

- Disadvantages: Requires regular payments, increases financial risk, may require collateral.

- Retained Earnings: Reinvesting profits back into the business instead of distributing them to owners or shareholders.

- Advantages: No dilution of ownership, no repayment obligation, provides a sustainable source of capital.

- Disadvantages: Limits short-term returns for owners, may not be sufficient for rapid growth, requires consistent profitability.

For Polar users, understanding these capital-raising methods can provide insights into how companies in the fitness technology industry finance their operations and growth. This knowledge can help users make informed decisions about investing in fitness technology companies and managing their personal finances. Polarservicecenter.net offers resources and support to help users maximize the value of their Polar products and stay informed about industry trends.

11. How Do The Cash Flow Characteristics Of A Business Influence Capital Raising Decisions?

The cash flow characteristics of a business significantly influence capital raising decisions by determining the amount, timing, and type of funding required. Businesses with stable and predictable cash flows may opt for debt financing, while those with uncertain or lumpy cash flows may prefer equity financing.

Here’s how cash flow characteristics impact capital raising decisions:

- Stability of Cash Flow: Companies with stable cash flows can comfortably take on debt, as they can reliably meet their repayment obligations.

- Predictability of Cash Flow: Predictable cash flows allow businesses to forecast their financial needs and plan their capital raising activities accordingly.

- Timing of Cash Flow: Businesses with long cash conversion cycles may require more upfront capital, making equity financing more attractive.

- Amount of Cash Flow: Companies generating substantial cash flows may rely on retained earnings to fund growth, reducing the need for external financing.

- Growth Rate: High-growth businesses may need to raise significant capital to fund expansion, often turning to equity financing or venture capital.

- Capital Intensity: Capital-intensive businesses, such as manufacturing or infrastructure companies, may require large amounts of debt financing to fund their operations.

- Risk Profile: Businesses with high-risk profiles may find it difficult to secure debt financing, making equity financing a more viable option.

For Polar users, understanding how cash flow characteristics influence capital raising decisions can provide insights into the financial strategies of fitness technology companies. This knowledge can help users make informed decisions about investing in fitness technology companies and managing their personal finances. Polarservicecenter.net offers resources and support to help users maximize the value of their Polar products and stay informed about industry trends.

12. What Questions Should Be Asked Before Deciding To Raise Capital?

Before deciding to raise capital, several critical questions should be addressed to ensure that the decision aligns with the company’s goals, financial situation, and long-term strategy. These questions help businesses evaluate their capital needs, assess their financing options, and mitigate potential risks.

Here are some essential questions to ask:

- What are our capital needs? Determine the amount of capital required to fund operations, growth initiatives, and strategic investments.

- What are our financing options? Evaluate the different sources of capital available, including equity, debt, and retained earnings.

- What are the costs and benefits of each option? Assess the financial and non-financial costs and benefits of each financing option.

- What is our risk tolerance? Consider the company’s ability to manage debt and the potential impact of equity dilution.

- What is our long-term strategy? Ensure that the capital raising decision aligns with the company’s long-term goals and vision.

- What are the potential risks? Identify and assess the potential risks associated with each financing option.

- What are the alternatives? Explore alternative strategies, such as bootstrapping or partnerships, before deciding to raise capital.

- How will this impact ownership and control? Understand the potential impact of equity financing on ownership and control of the company.

- What are the terms and conditions? Carefully review the terms and conditions of any financing agreement before committing.

- What is the impact on cash flow? Analyze the impact of the financing decision on the company’s cash flow and financial stability.

For Polar users, these questions can be adapted to inform personal financial decisions, such as purchasing fitness equipment, investing in health-related products, or subscribing to fitness services. Polarservicecenter.net offers resources and support to help users make informed decisions about managing their Polar products and optimizing their financial and health outcomes.

Polar H10 Heart Rate Sensor

Polar H10 Heart Rate Sensor

13. What Are The Potential Consequences Of Believing In A “Less Useful” Argument About The World?

Believing in a “less useful” argument about the world can lead to several negative consequences, including limited opportunities, missed potential, and suboptimal decision-making. When individuals or businesses base their actions on flawed or incomplete information, they may fail to recognize and capitalize on valuable opportunities.

Here are some potential consequences:

- Limited Opportunities: Individuals may overlook promising opportunities due to a narrow or inaccurate worldview.

- Missed Potential: Businesses may fail to reach their full potential by adhering to outdated or ineffective strategies.

- Suboptimal Decisions: Flawed arguments can lead to poor decision-making, resulting in financial losses and strategic setbacks.

- Resistance to Change: Holding onto less useful beliefs can make individuals and businesses resistant to change and innovation.

- Stunted Growth: A lack of adaptability can hinder personal and professional growth, leading to stagnation.

- Increased Risk: Relying on inaccurate information can increase the risk of making costly mistakes and facing unforeseen challenges.

- Reduced Competitiveness: Businesses that fail to adapt to changing market conditions may lose their competitive edge.

- Inefficient Resource Allocation: Less useful arguments can result in the inefficient allocation of resources, wasting time, money, and effort.

- Damaged Relationships: Holding onto flawed beliefs can strain relationships with colleagues, customers, and partners.

- Decreased Innovation: A rigid mindset can stifle creativity and innovation, hindering the development of new ideas and solutions.

For Polar users, believing in less useful arguments about fitness or health can lead to ineffective training routines, poor dietary choices, and missed opportunities to improve their well-being. Polarservicecenter.net offers resources and support to help users access accurate information, make informed decisions, and achieve their fitness goals effectively.

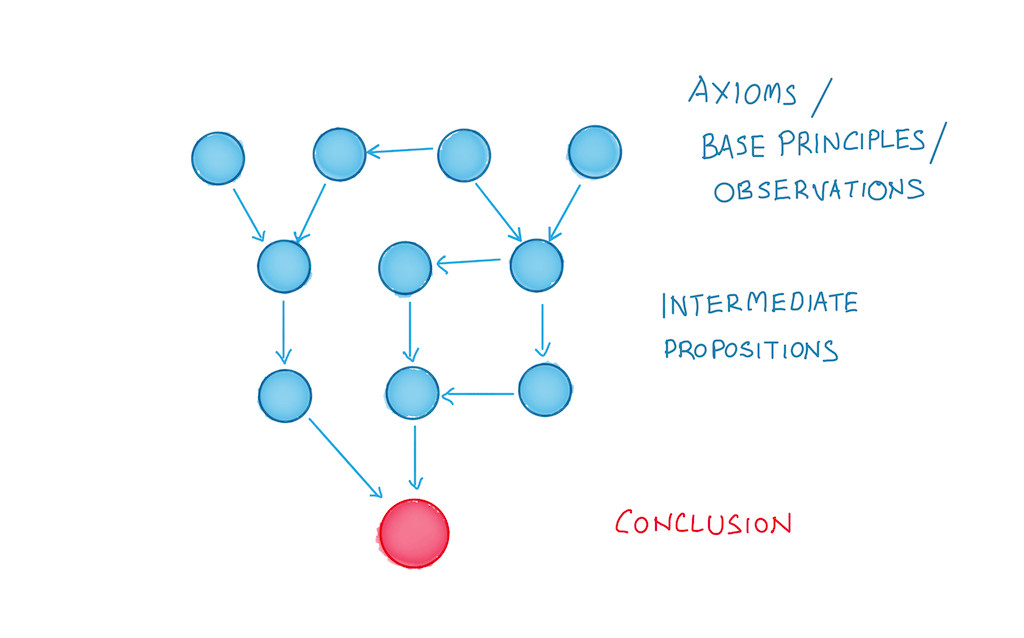

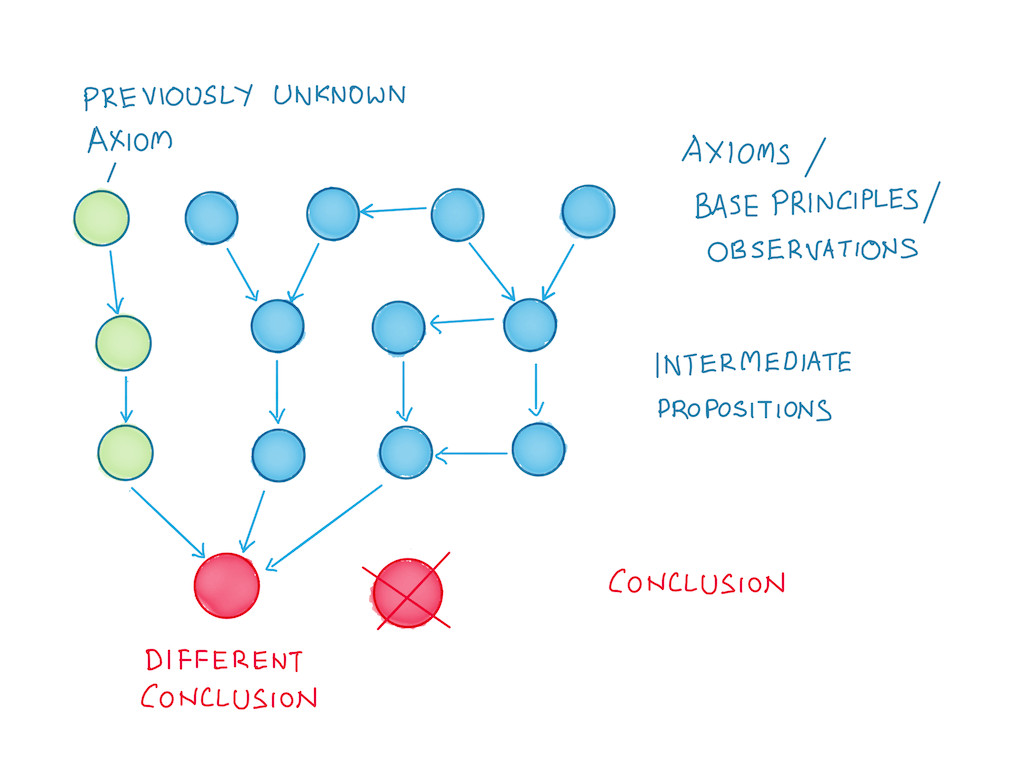

14. How Does The Understanding Of Cash Flow Relate To First Principles Thinking?

The understanding of cash flow relates to first principles thinking by providing a foundational understanding of business operations and financial sustainability. First principles thinking involves breaking down complex problems into their most basic elements and reasoning up from there. Cash flow, as a fundamental aspect of business, serves as a critical first principle for making informed decisions about capital allocation, investment, and growth.

Here’s how understanding cash flow aligns with first principles thinking:

- Foundational Knowledge: Cash flow is a core concept in business, essential for understanding how money moves in and out of an organization.

- Decision-Making: By understanding cash flow, businesses can make informed decisions about investments, financing, and operations.

- Problem-Solving: Cash flow analysis helps identify financial challenges and develop effective solutions.

- Strategic Planning: A strong understanding of cash flow is crucial for developing long-term strategic plans and achieving sustainable growth.

- Risk Management: Cash flow management helps mitigate financial risks and ensure the business can meet its obligations.

- Resource Allocation: Efficient cash flow management ensures that resources are allocated effectively to maximize returns.

- Performance Evaluation: Cash flow metrics provide a reliable measure of a company’s financial performance and sustainability.

- Innovation: Understanding cash flow can drive innovation by freeing up resources for research and development.

- Adaptability: Effective cash flow management allows businesses to adapt quickly to changing market conditions and financial challenges.

- Value Creation: Ultimately, a strong understanding of cash flow leads to greater value creation for the business and its stakeholders.

For Polar users, understanding cash flow can inform decisions about managing personal finances, investing in fitness technology, and optimizing their health and well-being. Polarservicecenter.net offers resources and support to help users access accurate information, make informed decisions, and achieve their fitness goals effectively.

15. What Resources Are Available At Polarservicecenter.net For Polar Users?

Polarservicecenter.net provides a comprehensive range of resources for Polar users, including troubleshooting guides, warranty information, authorized service center locations, software updates, and accessory details. These resources help users maintain their devices, resolve technical issues, and maximize their overall experience with Polar products.

The resources available include:

- Troubleshooting Guides: Step-by-step instructions for resolving common technical issues and device malfunctions.

- Warranty Information: Detailed information about Polar’s warranty policies, coverage, and claim procedures.

- Authorized Service Center Locations: A directory of authorized service centers in the USA, providing convenient access to professional repair services. Address: 2902 Bluff St, Boulder, CO 80301, United States. Phone: +1 (303) 492-7080.

- Software Updates: Access to the latest software and firmware updates to ensure optimal device performance and functionality.

- Accessory Details: Information about compatible accessories, replacement parts, and upgrades for Polar devices.

- User Manuals: Comprehensive user manuals and guides for understanding and utilizing all features of Polar products.

- FAQ Section: Answers to frequently asked questions about Polar devices, services, and support.

- Contact Support: Direct access to Polar customer support for personalized assistance and technical guidance.

- Product Registration: Option to register Polar products for warranty activation and access to exclusive resources.

- Community Forums: Links to official Polar community forums for connecting with other users and sharing experiences.

These resources are designed to support Polar users in various aspects of product maintenance, troubleshooting, and optimization. By accessing polarservicecenter.net, users can ensure they have the knowledge and support needed to fully enjoy their Polar devices and achieve their fitness goals.

Unlock Your Financial Fitness: Contact Us Now

Ready to take control of your finances and optimize your Polar experience? Visit polarservicecenter.net for expert troubleshooting guides, warranty information, and direct access to our support team in the USA. Whether you’re tackling technical issues or seeking to maximize your device’s potential, we’re here to help you succeed. Contact us today and let us assist you in achieving your financial and fitness goals.

Frequently Asked Questions (FAQs) About The Game Called Cash Flow

1. What exactly is the game called cash flow?

The game called cash flow refers to the management of money moving in and out of a business or personal finances, ensuring there is enough cash to cover expenses, invest in growth, and handle financial uncertainties.

2. Why is understanding the game called cash flow important for startups?

Understanding the game called cash flow is crucial for startups as it helps in making informed decisions about capital allocation, managing expenses, and ensuring financial stability during the initial growth phase.

3. How does the game called cash flow relate to profitability?

While profitability is important, the game called cash flow focuses on the actual movement of money, which can be more critical in the short term to meet obligations and fund operations, unlike profit which is an accounting measure.

4. What are some strategies to improve the game called cash flow in a business?

Efficient invoicing, managing expenses, strategic financing, and negotiating favorable payment terms are effective strategies to improve the game called cash flow in a business.

5. How can payment terms be used to optimize the game called cash flow?

Offering early payment discounts and negotiating extended payment terms with suppliers can help accelerate cash inflows and delay cash outflows, thus optimizing the game called cash flow.

6. What role does speed play in the game called cash flow management?

Speed in invoicing, inventory turnover, and customer service ensures that cash is not tied up unnecessarily, improving the overall efficiency of the game called cash flow.

7. How can pre-payments benefit the game called cash flow in a business?

Pre-payments provide an immediate cash influx, reducing financial risk and improving supplier relationships, which significantly benefits the game called cash flow.

8. What are the three primary ways to raise capital and how do they impact the game called cash flow?

The three primary ways are equity financing, debt financing, and retained earnings, each impacting the game called cash flow differently based on repayment obligations, dilution of ownership, and financial risk.

9. How do the cash flow characteristics of a business influence capital-raising decisions?

The stability, predictability, and amount of cash flow influence capital-raising decisions, determining the type and timing of funding needed to sustain and grow the business.

10. What are some key questions to ask before deciding to raise capital to improve the game called cash flow?

Key questions include assessing capital needs, evaluating financing options, understanding risk tolerance, and ensuring alignment with the long-term strategy.