Dcm Services is a debt collection agency that operates uniquely within the financial landscape. Unlike typical collection agencies, DCM Services specializes in estate debt, targeting unpaid debts left behind by deceased individuals. This often involves contacting relatives to settle these outstanding balances. If you’ve been contacted by DCM Services, it’s crucial to understand your rights and responsibilities. Before providing any personal information, it’s important to verify the debt in question. DCM Services frequently acquires debts from original creditors, which means their information may be outdated or incomplete. If you believe you are legitimately responsible for a debt collected by DCM Services but are facing difficulties in repayment, seeking legal counsel is a prudent step, especially given the complex and often ambiguous legal aspects of debt collection from deceased estates, particularly concerning medical bills.

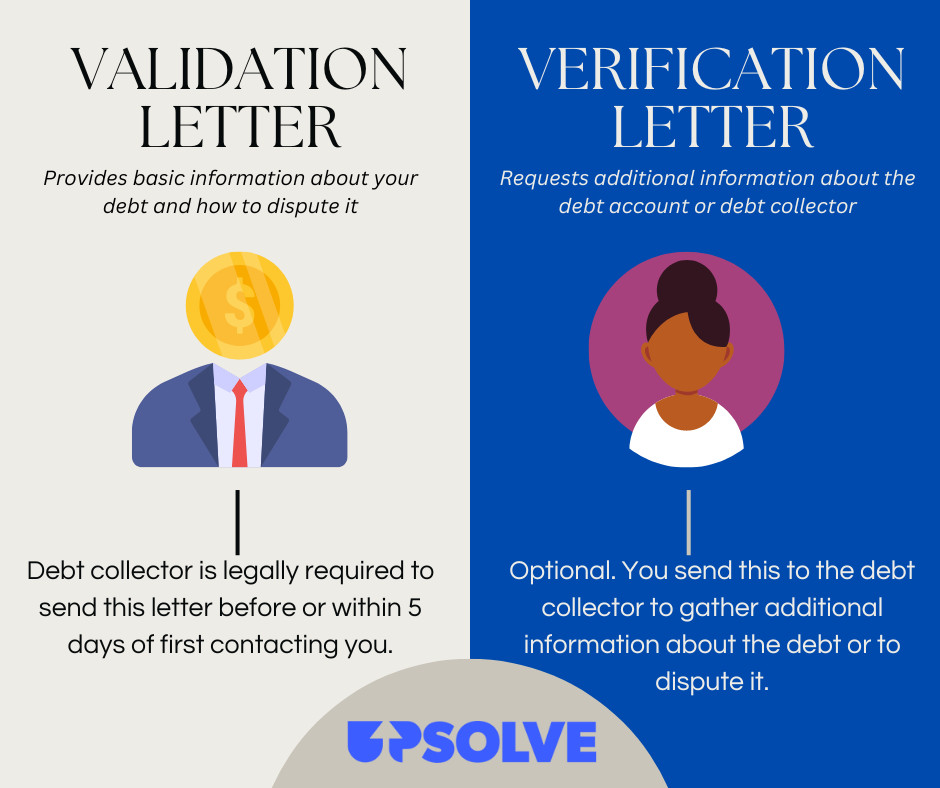

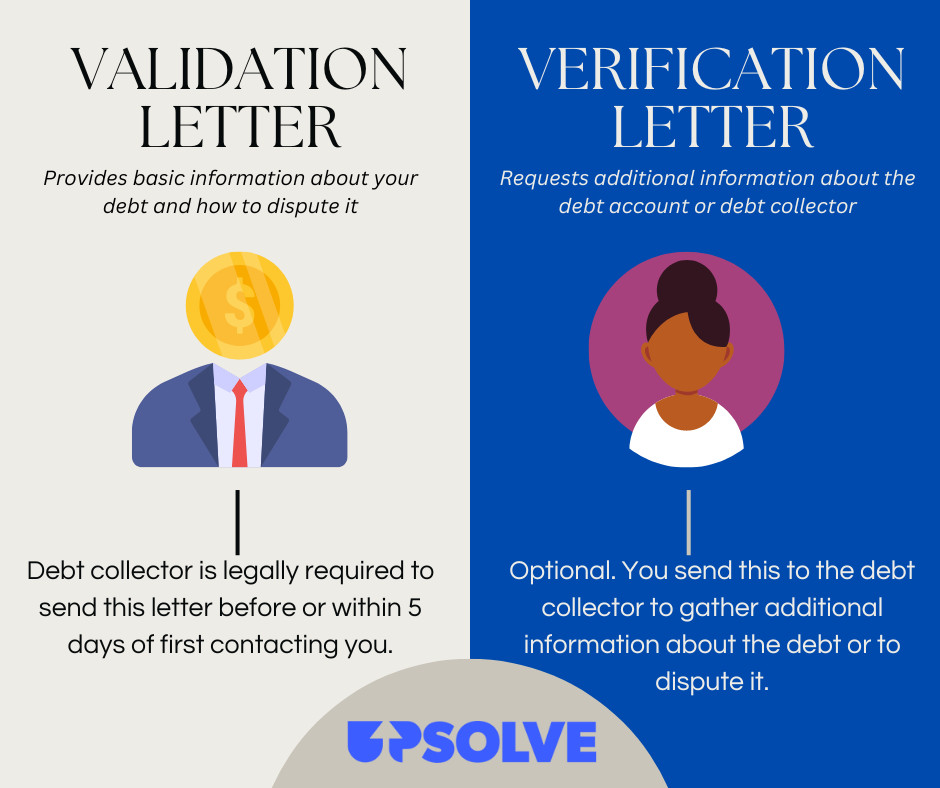

Debt Validation Vs. Debt Verification Letters

Debt Validation Vs. Debt Verification Letters

What Exactly is DCM Services?

DCM Services, LLC, based in Bloomington, Minnesota, is a third-party debt collection agency with a specific focus. While they do purchase various types of debt, including from retailers, telecommunications providers, and auto loan companies, their primary area of focus is debt from healthcare companies. What truly distinguishes DCM Services in the debt collection industry is their specialization in pursuing debts from the estates of deceased individuals. When someone passes away, their assets, including financial accounts, property, and possessions, are considered part of their estate. These assets are then used to settle outstanding debts. The responsibility of managing and distributing these estate assets falls to the estate’s personal representative.

To effectively operate in this niche, DCM Services employs specialized technology, notably Probate Finder OnDemand. This system allows them to track probate filings and death records, enabling them to identify potential estates with outstanding debts and locate the personal representatives responsible for managing those estates. This targeted approach allows DCM Services to efficiently pursue debt collection related to deceased individuals.

Why is DCM Services Reaching Out To You?

It’s common for individuals contacted by DCM Services to have recently experienced the loss of a family member. The initial contact from DCM Services is often an attempt to locate the personal representative of the deceased’s estate.

The Consumer Financial Protection Bureau (CFPB) clarifies that if you are not the surviving spouse, the parent of a deceased minor, or the designated personal representative of the estate, DCM Services’ contact is limited. In such cases, they are only permitted to contact you once to inquire about the personal representative. Legally, they are restricted from discussing the debt itself in these initial contacts, which is why their communication might seem vague. You are under no obligation to provide them with any information at this stage.

However, if you are the surviving spouse, parent of a deceased minor, or the personal representative of the estate, DCM Services may discuss the debt with you. It’s important to remember that even in these roles, you are not automatically personally liable for the debt, especially not from your personal funds. Navigating this situation often requires further action and seeking legal advice can be beneficial to understand your obligations and the estate’s responsibilities.

Is DCM Services a Legitimate Operation?

Yes, DCM Services is indeed a legitimate debt collection company, with a history dating back to 2006. They hold accreditation from the Better Business Bureau (BBB) and maintain a high rating of A+. Despite this, it’s worth noting that consumer reviews and complaints do exist. Over the past three years, 28 complaints have been filed against DCM Services with the BBB, and their Google rating stands at 1.5 stars out of 5.

Consumer feedback found on platforms like BBB and Google often highlights recurring issues with DCM Services’ practices:

- Persistent and repeated phone calls and letters.

- Attempts to collect debts that are not valid or do not exist.

- Efforts to collect debts already covered by insurance payouts.

Please note: These reported experiences, while insightful, may not reflect the experiences of all individuals contacted by DCM Services.

If you encounter similar issues, it’s important to be aware of your protections under the Fair Debt Collection Practices Act (FDCPA). This federal law safeguards consumers from abusive, unfair, and deceptive debt collection tactics. For instance, if you are receiving incessant calls, you have the right to request that they cease phone communication and communicate with you solely through mail. Always keep copies of any correspondence you send. If a debt collector violates your rights or engages in prohibited behavior, you have the option to report them to the CFPB.

While DCM Services is a legitimate agency, it’s also important to be vigilant against potential scams that may use their name to fraudulently solicit money. If any communication feels suspicious, it’s wise to request detailed information and verify the legitimacy of the debt before disclosing any personal details. Familiarize yourself with common red flags associated with debt collection scams to protect yourself.

Are You Obligated to Pay DCM Services?

It’s crucial to understand that you should not automatically assume you are responsible for paying DCM Services. As a survivor, your responsibility for the debts of a deceased loved one is limited to specific circumstances, such as:

- Being a co-signer on a loan with an outstanding balance, making you legally jointly responsible for repayment.

- Being a joint account holder on a credit card, sharing the debt liability.

- Being the designated personal representative of the deceased’s estate, in which case you manage debt settlement from estate assets.

- Being the spouse of the deceased, as laws regarding spousal debt responsibility vary by state.

Even if you are a surviving spouse or manage the estate, DCM Services cannot legally demand payment of the deceased’s debts from your personal funds. If you are the estate’s personal representative, you may need to settle debts, but this should be done using estate assets and only after prioritizing payments to any surviving dependents or beneficiaries as per state laws. Estate administration and debt settlement are governed by state-specific regulations, making legal guidance highly recommended.

If any of the aforementioned circumstances apply to you, the immediate next step is debt validation.

Debt validation is essential to confirm:

- Whether the debt is actually legitimately owed by the deceased’s estate.

- That DCM Services legally owns the right to collect this specific debt.

- The claimed debt amount is accurate and correct.

If DCM Services successfully validates the debt and confirms your or the estate’s responsibility, you will then need to determine the appropriate course of action for resolution.

Initiate Debt Verification with a Letter

If you suspect you might be responsible for the debt on behalf of the deceased’s estate, your first action should be to formally request debt details from DCM Services in writing. Ideally, DCM Services should have already sent you a debt validation letter. This letter is legally required and should contain key information about the debt. They are obligated to send this either before or within five days of their initial contact with you.

If you haven’t received a validation letter, it’s advisable to send your own debt verification letter to DCM Services.

Debt Validation Vs. Debt Verification Letters

Debt Validation Vs. Debt Verification Letters

Upon receiving a debt validation letter, you have a 30-day window to dispute the debt. During this period, debt collectors are prohibited from contacting you further or proceeding with collection efforts. If DCM Services fails to provide debt verification within this timeframe, you are generally not obligated to pay.

If DCM Services successfully verifies the debt, you retain the right to dispute the debt. This is often the point where seeking legal advice becomes particularly valuable.

Whenever you are contacted by a debt collection agency, regardless of the reason, it’s prudent to review your credit report. This allows you to verify the accuracy of reported debts and identify any errors. It is not uncommon for debt details to be inaccurate or incorrectly reflected on credit reports. The Fair Credit Reporting Act (FCRA) grants you the right to dispute inaccuracies on your credit report. You can initiate this process by sending a credit dispute letter.

Consequences of Ignoring DCM Services

If you are a relative of the deceased but not the spouse, personal representative, or joint account holder, you can generally disregard DCM Services’ contact. A more proactive approach would be to formally request in writing that they cease all communication with you.

However, if you are the spouse, personal representative, or joint account holder, being contacted by DCM Services while grieving can be an unwelcome stressor. While ignoring them might seem tempting, it’s generally not advisable if you have potential liability for the debt.

Ignoring DCM Services when you are responsible for the debt can lead to negative repercussions, including:

- Damage to your credit score.

- Increased debt due to accruing interest and additional fees over time.

- Potential legal action, including lawsuits.

- Ongoing stress and anxiety associated with unresolved financial obligations.

Key Takeaway: Dealing with a debt collection agency while grieving the loss of a family member is understandably the last thing you want to do. However, depending on your relationship to the deceased and state laws, addressing the situation is often necessary. Obtain detailed information about the debt, conduct thorough research, and don’t hesitate to seek legal guidance if you feel uncertain or overwhelmed.

Can DCM Services Initiate a Lawsuit?

Yes, it is possible for DCM Services to sue you, although it’s relatively less common compared to other types of debt collection agencies, given the complexities of estate debt. Estate debt collection often operates in a legally ambiguous area, and the laws governing repayment vary significantly depending on the state and the type of debt, such as medical bills or auto loans.

Should you be sued, you will receive official court documents, typically a summons and complaint, which are often delivered in person or left at your residence.

If you are concerned about responding to a lawsuit on your own and cannot afford legal representation, resources are available. Services like SoloSuit can assist in drafting an answer letter for free or for a nominal fee. They specialize in helping individuals respond to debt lawsuits and offer a money-back guarantee.

In Summary

DCM Services is a debt collection agency specializing in collecting unpaid debts from deceased individuals, primarily targeting the estate’s personal representative. If DCM Services contacts you, your response should be guided by your relationship to the deceased and the applicable state laws. Given the intricacies of estate debts, seeking legal counsel is often a prudent step.

Authored by:

Upsolve’s content is created by a team of bankruptcy attorneys and financial professionals dedicated to providing up-to-date, informative, and helpful resources.

![Jonathan Petts]()

Legally Reviewed by:

LinkedIn Jonathan Petts, co-founder and CEO of Upsolve, brings over a decade of bankruptcy law experience. With an LLM in Bankruptcy from St. John’s University and experience clerking for federal bankruptcy judges and working at top NYC law firms, his expertise ensures the legal accuracy of our content. Read more about Jonathan Petts